Elevate Your Trading with XAUUSD Trend Following EA

Discover the power of trend following with the XAUUSD Trend Following EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL. This Expert Advisor capitalizes on trending markets by providing accurate and timely buy and sell signals based on Simple Moving Average (SMA) crossovers.

Whether you are a novice or an experienced trader, the XAUUSD Trend Following MT4 Expert Advisor offers a powerful, automated solution to enhance your trading strategy and boost your profitability.

How It Works: Harnessing Market Trends for Success

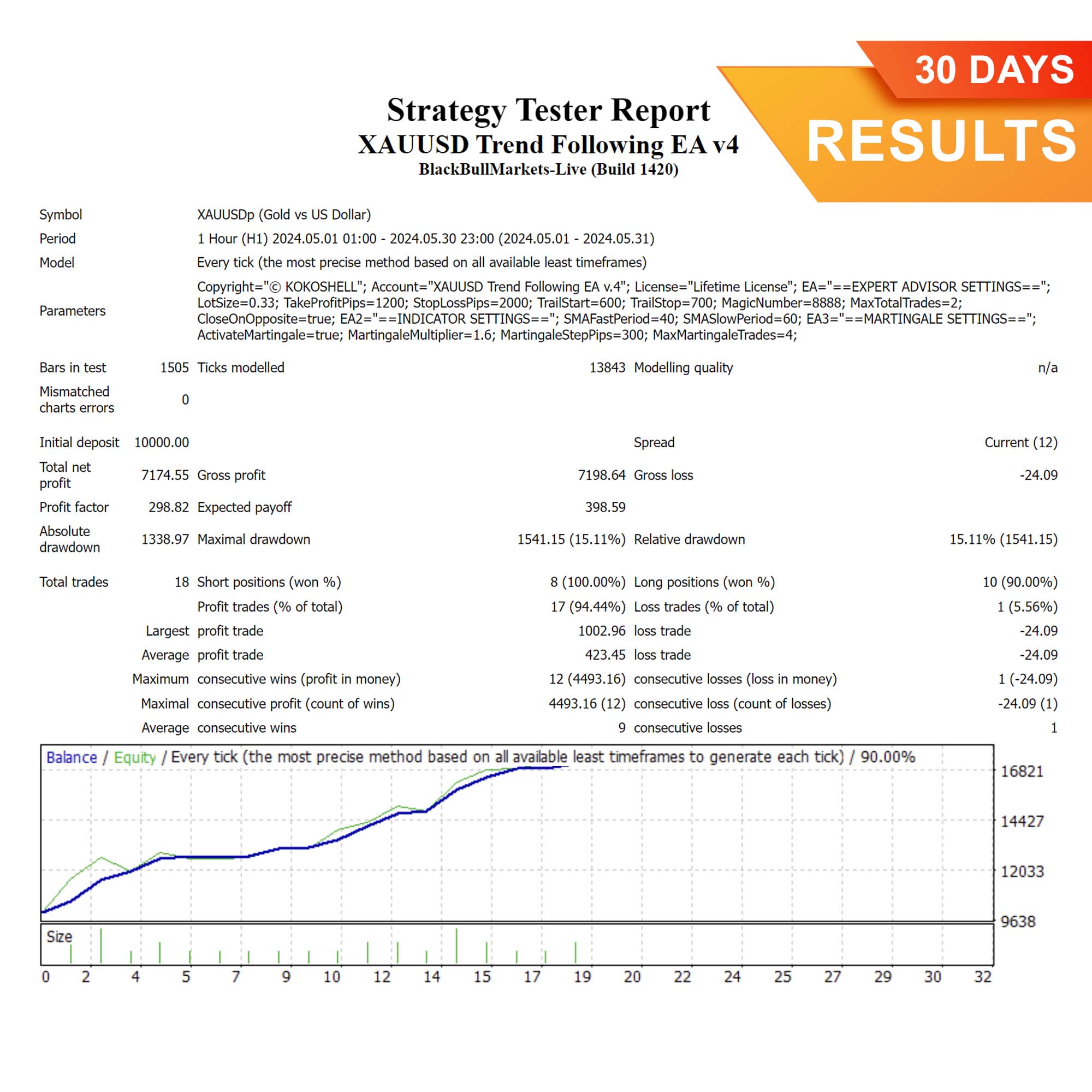

The XAUUSD Trend Following EA analyzes market trends using fast and slow Simple Moving Averages (SMAs). When the fast SMA crosses the slow SMA, the EA generates buy or sell signals, indicating the beginning of a new trend.

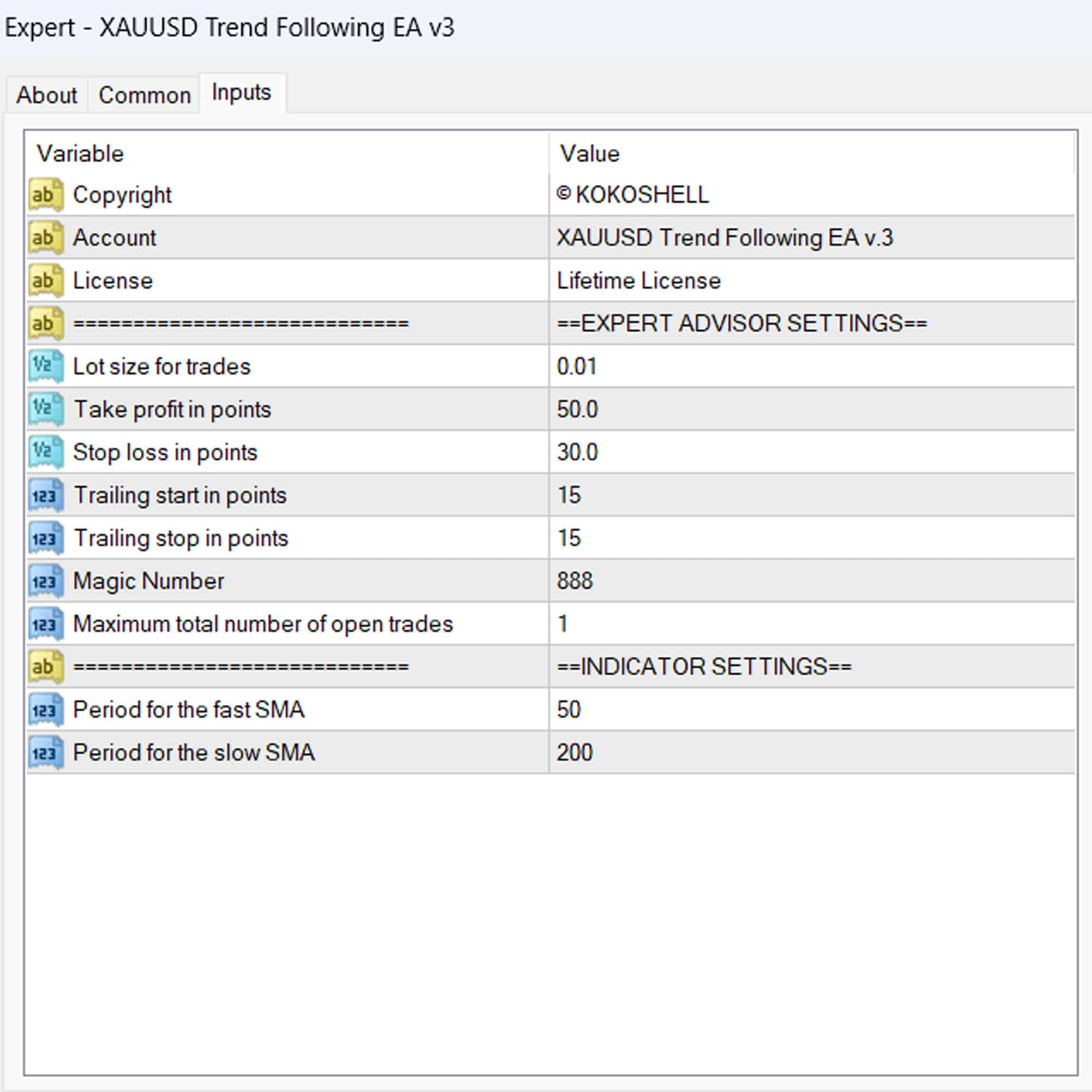

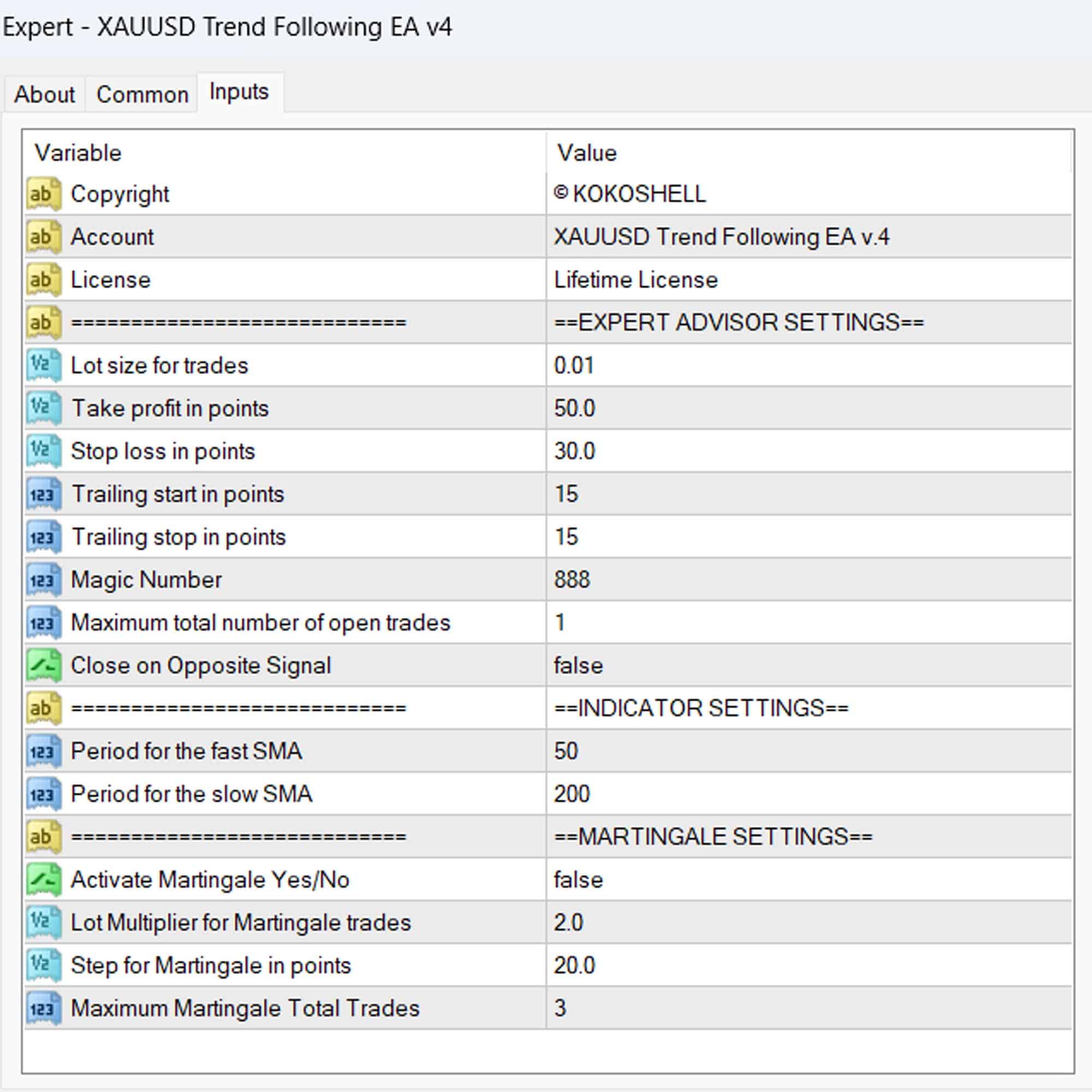

Additionally, the EA features robust risk management tools, including customizable lot sizes, take profit, stop loss, and trailing stops, ensuring effective and efficient trade management. For traders looking to maximize their recovery potential, the built-in Martingale strategy can increase lot sizes after losses.

Key Features: Advanced Tools for Superior Trading

- Precision Entry Signals: Utilizes SMA crossovers to generate precise buy and sell signals.

- Dynamic Trailing Stops: Adjusts stop-loss levels as trades move in your favor, securing profits effectively.

- Martingale Strategy: Optional feature to multiply lot sizes on losing trades, enhancing recovery potential.

- Customizable Settings: Tailor parameters such as lot size, take profit, stop loss, and trailing stops to suit your trading style.

- Risk Management: Comprehensive risk management features to protect your investments.

- Automated Trading: Fully automated trading allows you to set it and forget it, optimizing your trading efficiency.

- Lifetime License: One-time purchase with lifetime access and updates.

Why Choose XAUUSD Trend Following EA: Achieve Consistent Success

XAUUSD Trend Following EA for Metatrader 4 excels due to its robust and reliable performance. By leveraging the power of SMA crossovers, it identifies trading opportunities that other strategies might miss. Its customizable settings allow you to tailor the EA to your specific needs, whether you’re looking for aggressive growth or steady, conservative gains.

The optional Martingale strategy adds an extra layer of potential profitability, making it a versatile tool in any trader’s arsenal.

Elevate Your Trading with XAUUSD Trend Following EA

Incorporate the XAUUSD Trend Following EA into your trading strategy and experience the benefits of automated, precise, and profitable trading. With its advanced features and robust risk management, this Expert Advisor helps you achieve consistent trading success. Don’t miss the opportunity to elevate your trading game—try the XAUUSD Trend Following Expert Advisor for Metatrader 4 by KOKOSHELL today.

James –

Amazing profits! Highly recommend.

Michael Johnson –

Great risk management. Could use more input parameters.

David –

Consistent profits! This EA transformed my trading. Simple setup, reliable performance.

John Davis –

Outstanding performance! The trend-following strategy is on point, delivering consistent gains. Setup was straightforward, and the results have exceeded my expectations. Highly recommend for any serious trader looking to enhance their portfolio.

Jose –

Good performance, but limited customization. Still worth the price.

Matthew Wilson –

Profitable and reliable EA! This tool has boosted my trading success significantly. The trend-following strategy is impressive, and the risk management features provide peace of mind. A must-have for anyone in the trading game.

Sarah Brown –

Using this trading advisor has been a game-changer. The setup was hassle-free, and the profits started coming in almost immediately. The strategic approach it takes is impressive, and the risk management is top-tier. Trading has become stress-free and profitable. I couldn’t be happier with the results.