Elevate Your Trading with Wealth Wave EA

Introducing Wealth Wave EA (Expert Advisor) for MT4 (Metatrader 4), the latest innovation from KOKOSHELL designed to transform your forex trading experience. Moreover, this Expert Advisor harnesses sophisticated technical indicators and powerful algorithms to deliver unmatched trading performance. Whether you’re a novice trader or an experienced professional, Wealth Wave Expert Advisor provides a seamless, automated solution to help you achieve consistent profits.

How It Works: Intelligent Automation for Optimal Results

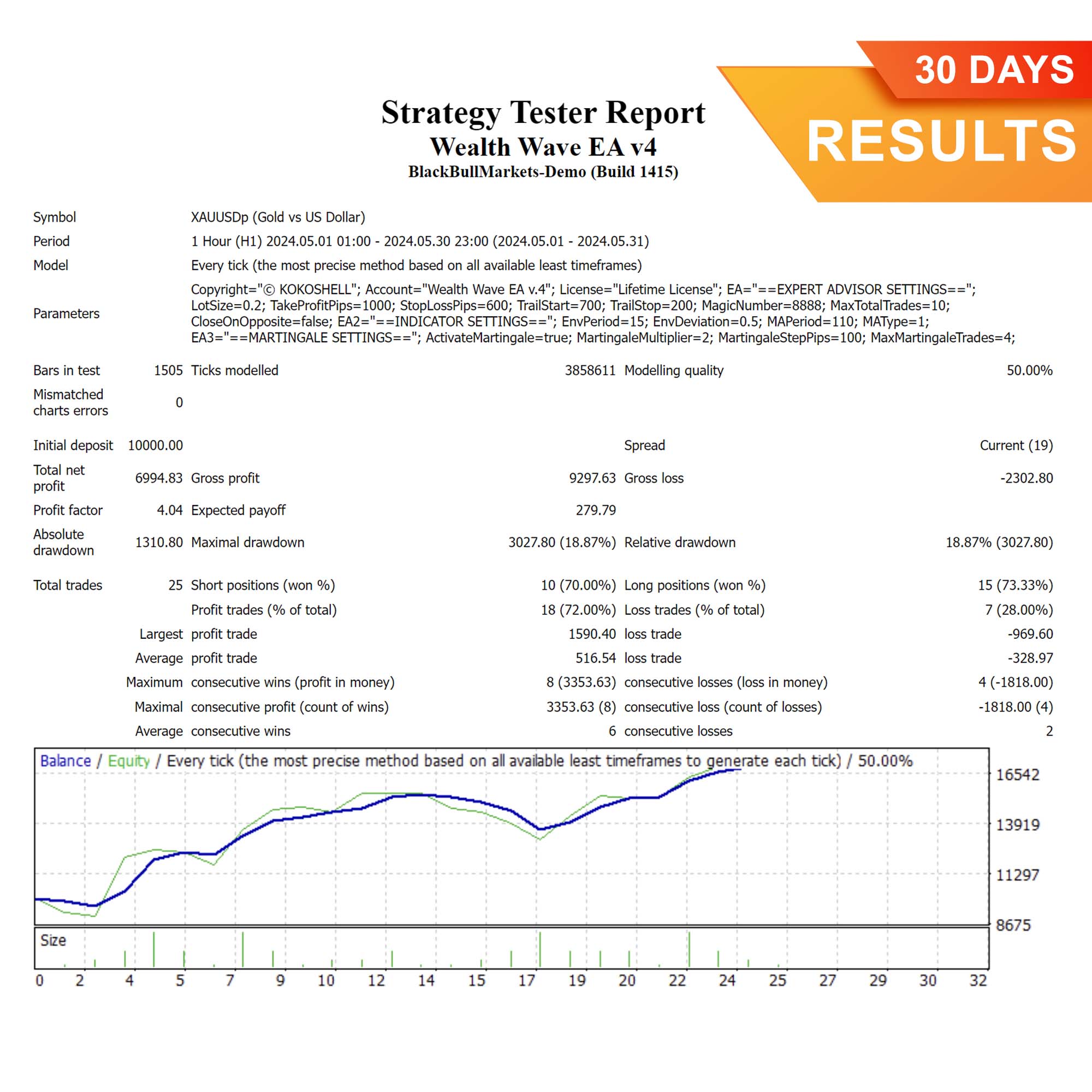

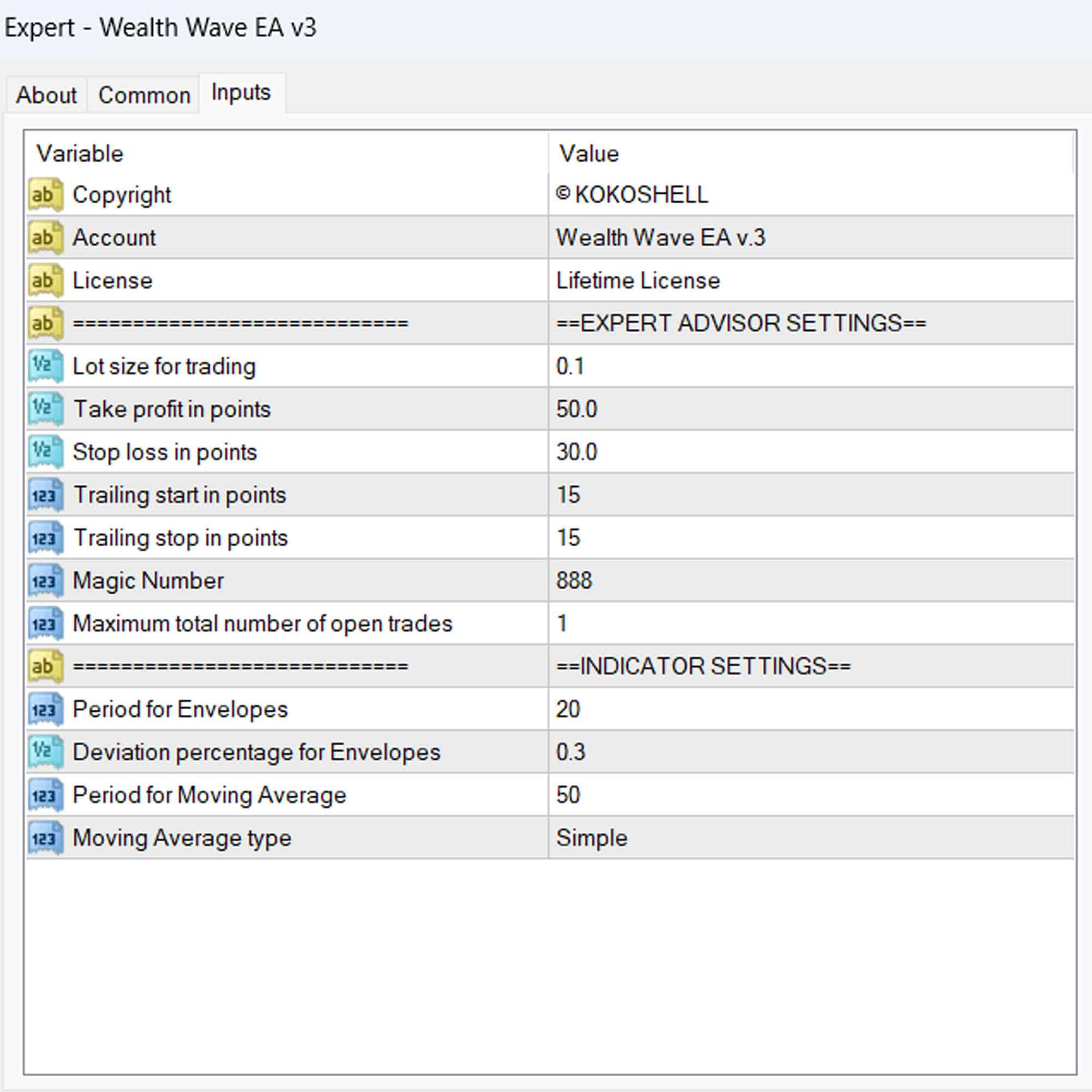

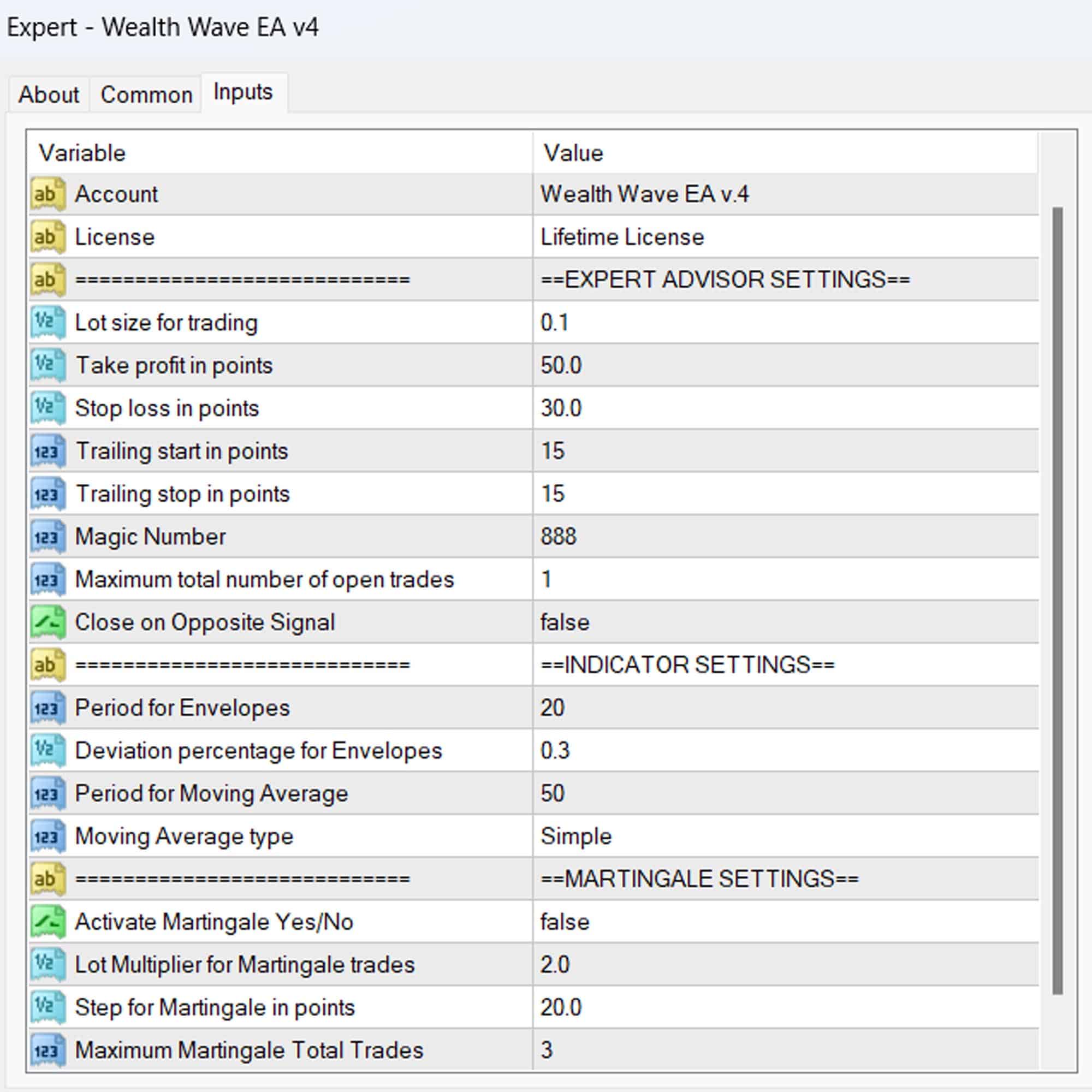

Wealth Wave EA operates by analyzing market conditions using Envelopes and Moving Average (MA) indicators. When the price crosses the Envelopes and aligns with the MA trend, the EA generates precise buy or sell signals. Additionally, Wealth Wave Expert Advisor for Metatrader 4 incorporates a trailing stop mechanism to secure profits. Furthermore, it includes an optional Martingale strategy to manage and recover from losses effectively.

Key Features: Advanced Tools for Superior Trading

- Precision Entry Signals: Utilizes Envelopes and MA indicators for accurate buy and sell signals.

- Dynamic Trailing Stops: Adjusts stop-loss levels as the trade moves in your favor, thus securing profits effectively.

- Martingale Strategy: Offers an optional feature to multiply lot sizes on losing trades, aiming to recover losses quickly.

- Customizable Settings: Allows you to tailor parameters like lot size, take profit, stop loss, and more to fit your trading style.

- Risk Management: Limits the maximum number of open trades and manages risk with intelligent stop-loss strategies.

- Lifetime License: Includes a one-time purchase with lifetime access and updates.

Why Choose Wealth Wave EA: Elevate Your Trading Strategy

- Consistent Performance: Designed to deliver reliable results in various market conditions, thereby ensuring steady growth.

- User-Friendly Interface: Provides easy setup and configuration, suitable for traders of all experience levels.

- Proven Strategy: Built on time-tested trading principles and advanced algorithms for optimal performance.

- Reliable Support: Offers dedicated customer support to assist with any questions or issues.

- Comprehensive Risk Management: Incorporates robust risk management tools to safeguard your investments and enhance profitability.

Transform Your Trading with Wealth Wave MT4 Expert Advisor

Incorporate Wealth Wave Expert Advisor into your trading strategy and experience the benefits of automated, precise, and profitable trading. Additionally, with its advanced features and robust risk management, this Expert Advisor is designed to help you achieve consistent trading success. Consequently, don’t miss the opportunity to elevate your trading game—try Wealth Wave EA for Metatrader 4 today.

Furthermore, Wealth Wave Expert Advisor ensures that traders of all levels can maximize their trading potential. Its intuitive design and automated features allow you to focus on strategy rather than manual adjustments. Thus, the Wealth Wave Expert Advisor is a vital tool for anyone looking to improve their trading outcomes.

Emily Scott –

This EA has taken my trading to the next level. I’m consistently hitting my profit targets.

Jack Thompson –

Effective tool. Helped me make more informed trading decisions.

Olivia Ramirez –

My trading has never been better. Highly recommend this EA for all serious traders.

Carlos Green –

It’s a decent tool, but I found it a bit hard to customize.

Carlos Green –

It’s a decent tool, but I found it a bit hard to customize.

Ava Clark –

Outstanding EA! It has improved my trading strategy significantly.

Lucas Johnson –

Good overall performance, but it took some time to get used to it.

Isabella White –

This tool is fantastic! My profits have steadily increased since I started using it.

Liam Harris –

Very helpful EA, but it could use better documentation for beginners.

Emma Wilson –

Highly reliable and accurate. This EA has transformed my trading approach.

Ethan Brown –

Excellent tool! Easy to set up and yields great results.

Mia Hernandez –

Good performance overall. Helped me stay consistent with my trades.

Benjamin Scott –

I’m thrilled with the results. This EA has made my trading so much easier and profitable.

Chloe Davis –

It’s a decent product, but I wish it had more features.

Daniel Martinez –

Highly recommend it! My trading has improved tremendously.

Sofia Lewis –

Good tool, but it takes some time to master.

Nicholas Taylor –

Wow, this trading advisor is a true gem! Setting it up was a breeze, and I was thrilled to see my profits skyrocket almost immediately. The strategy it uses is incredibly effective, and I love how it manages risk so well. It’s turned trading into a stress-free, profitable experience. Don’t hesitate – this tool is a must-have!