Achieve Trading Excellence with Golden Algorithm EA

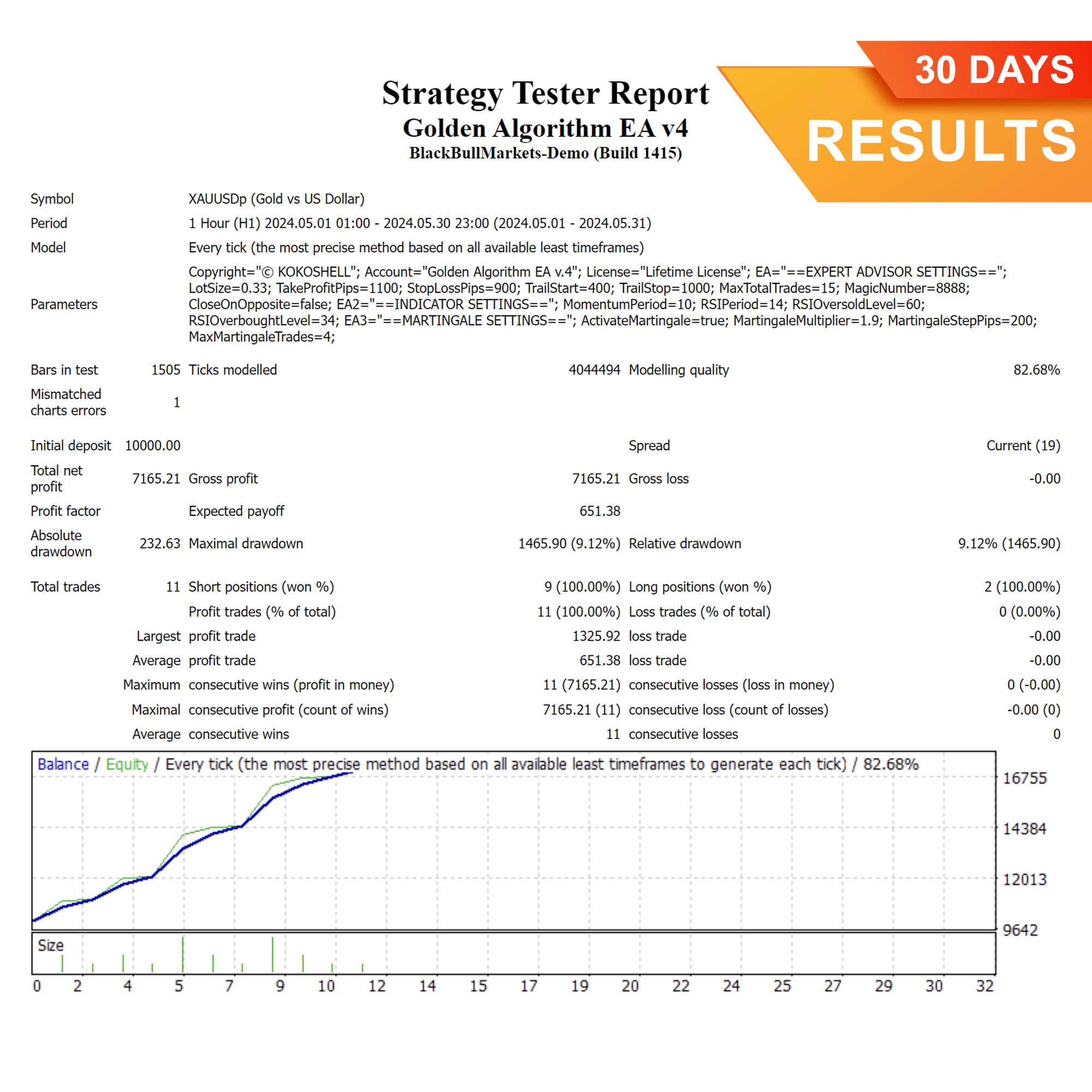

Unlock the potential of automated trading with the Golden Algorithm EA (Expert Advisor) for MT4 (Metatrader 4). Moreover, this EA enhances your trading strategy by leveraging advanced indicators and automated trading logic. Whether you’re a seasoned trader or a newcomer, Golden Algorithm Expert Advisor offers an intelligent solution for optimizing your trading performance in the dynamic forex market.

How It Works: Advanced Strategies for Smarter Trading

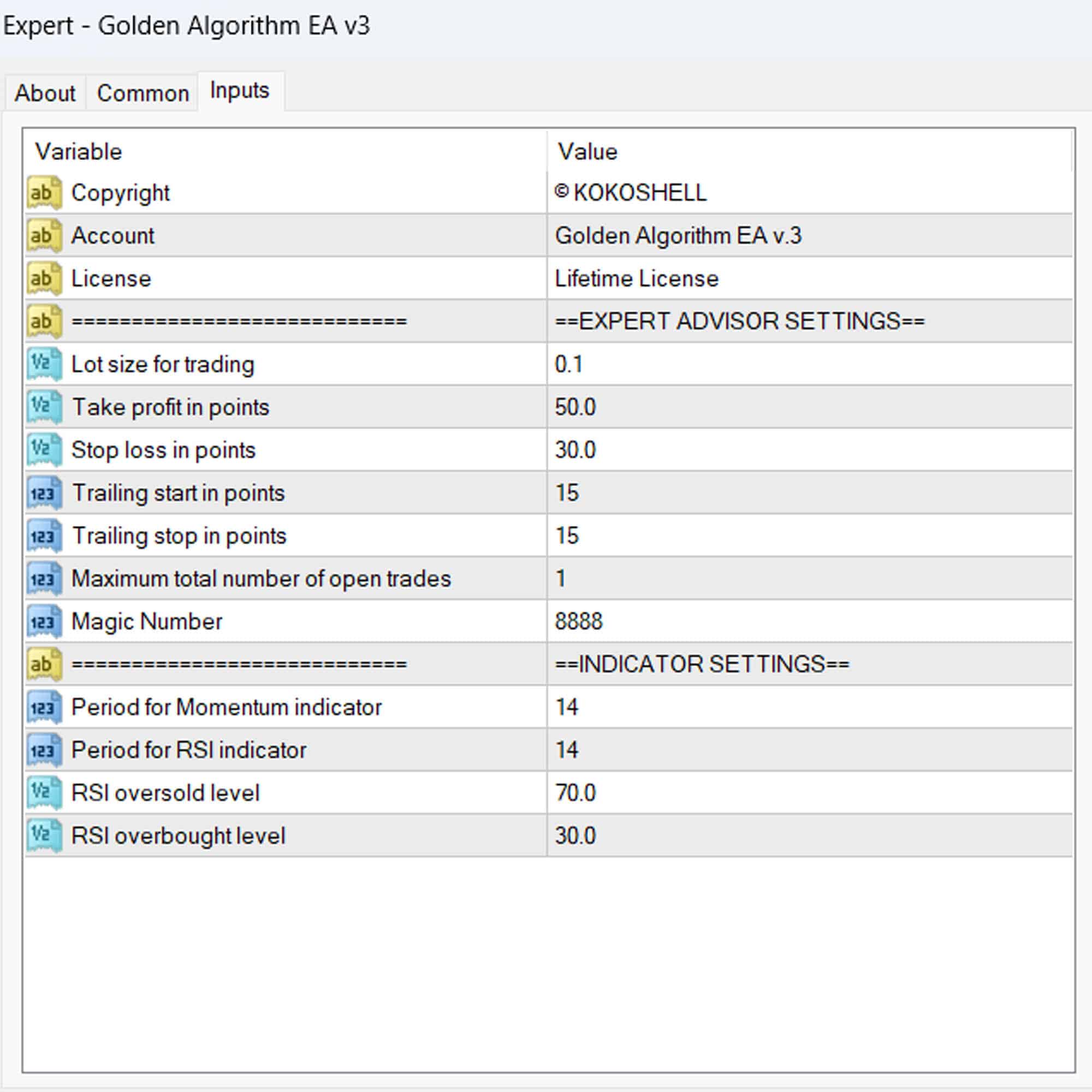

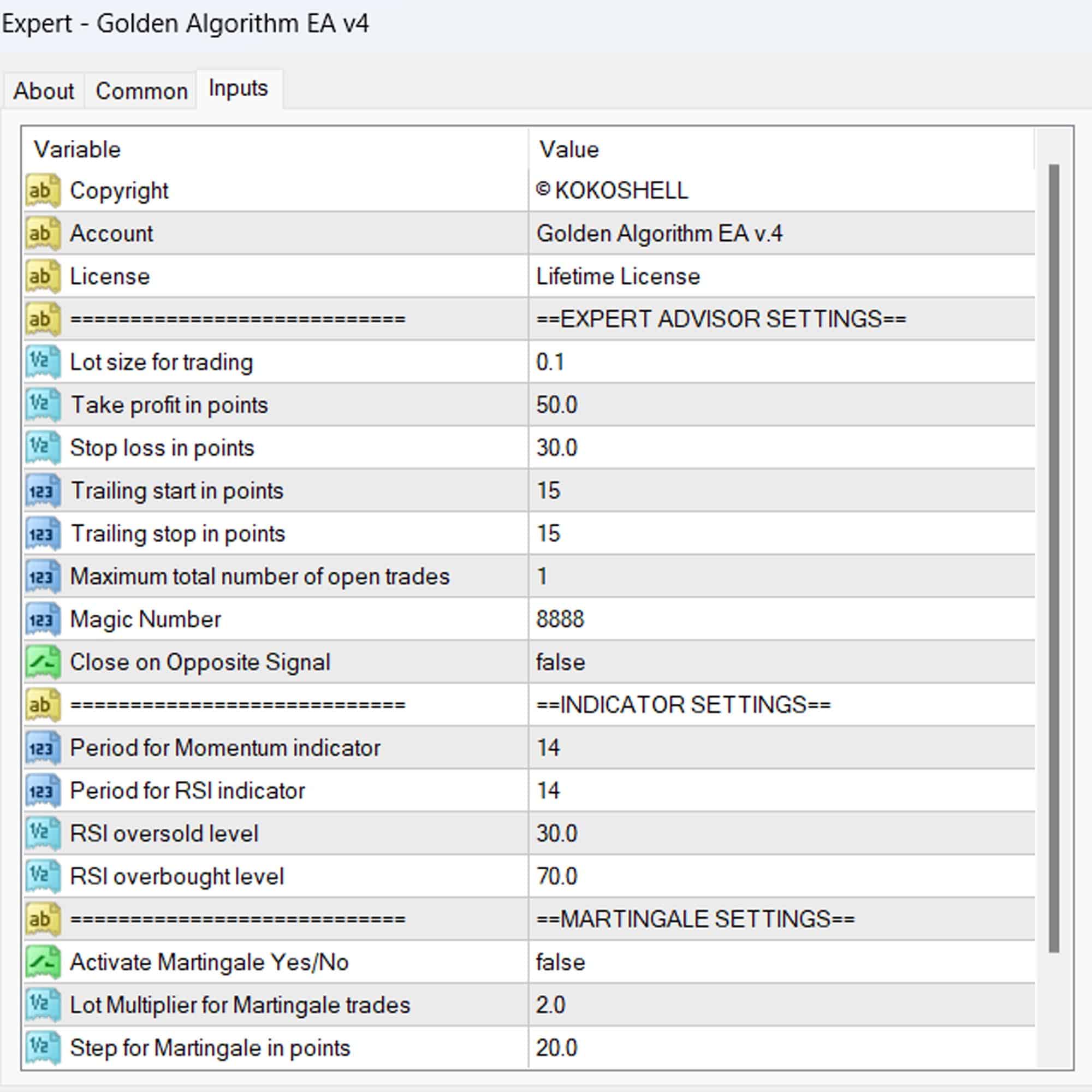

Golden Algorithm EA combines the power of the Momentum and Relative Strength Index (RSI) indicators. Consequently, the EA generates buy and sell signals based on these indicators, ensuring trades are executed at optimal times.

For example, when the Momentum indicator signals an increase and the RSI remains below the overbought level, the EA triggers a buy order. Conversely, when the Momentum indicator signals a decrease and the RSI stays above the oversold level, the EA initiates a sell order. This dual-indicator approach enhances the accuracy and reliability of trade signals.

Key Features: Innovative Tools for Enhanced Trading

- Precision Signal Generation: Utilizes Momentum and RSI indicators for accurate buy and sell signals. Therefore, you can rely on these signals for your trading decisions.

- Customizable Parameters: Adjust lot size, take profit, stop loss, and trailing stops to fit your trading style. Furthermore, this customization ensures the Golden Algorithm EA matches your specific needs.

- Martingale Strategy: Optional Martingale feature to amplify profits by increasing trade sizes after losses. Additionally, this strategy can potentially enhance profitability.

- Automated Execution: Ensures timely and efficient trades by executing automatically based on predefined criteria, thus reducing manual intervention and errors. Consequently, you can focus on strategy rather than execution.

- Comprehensive Risk Management: Implements robust risk management tools to protect your capital and minimize losses. Moreover, these tools provide a safety net for your investments.

- Lifetime License: Benefit from continuous updates and support with a one-time purchase. Additionally, this ensures long-term value for your investment.

Why Choose Golden Algorithm EA: Your Key to Consistent Profits

Golden Algorithm EA for Metatrader 4 stands out for its ability to integrate Momentum and RSI indicators, thereby providing a powerful and reliable trading solution. Moreover, its extensive customization options allow you to fine-tune your trading strategy. The automated execution ensures timely and efficient trades.

Additionally, the optional Martingale strategy offers an added edge, potentially increasing profitability. By choosing Golden Algorithm MT4 Expert Advisor, you gain a competitive advantage, achieving consistent and enhanced trading results.

Transform Your Trading Journey with Golden Algorithm EA

Elevate your trading to new heights with the KOKOSHELL Golden Algorithm Expert Advisor for Metatrader 4. This Expert Advisor delivers a comprehensive, automated trading solution, leveraging the proven effectiveness of Momentum and RSI indicators. Moreover, with extensive customization, robust risk management, and an optional Martingale strategy, Golden Algorithm Expert Advisor optimizes your trading performance. Consequently, you can achieve your trading goals with greater confidence and success.

Ethan Miller –

Golden Algorithm EA boosted my trading profits. It’s incredibly efficient.

Emily Clarke –

Very useful tool. Enhanced my trading strategy significantly.

Liam Thompson –

Fantastic results with this EA. My trades are more accurate and profitable.

Ava Mitchell –

Effective EA, but the setup was a bit complex. Worth it in the end.

Noah Johnson –

My trading performance improved drastically. Highly recommend Golden Algorithm EA.

Sophia Brown –

Great tool for consistent trades. Took some time to master, but very effective.

Lucas Anderson –

Outstanding EA! My trading success has increased significantly since using it.

Olivia Green –

Solid performance overall. Helps me stay consistent with trades.

Sarah Lee –

Using this advisor has been a game-changer for me. The setup was so simple, and the results were almost immediate. Its strategic approach to trading is impressive, and the risk management features are excellent. I’ve never felt more confident and secure in my trades. This tool is definitely worth it!