Unlock the Power of Automated Trading

The Trade Genius EA for Metatrader 4 (MT4) is a state-of-the-art Expert Advisor designed to elevate your trading performance. Moreover, by leveraging advanced indicators such as the DeMarker and Moving Average, this EA provides precise entry and exit signals, ensuring you maximize profits while minimizing risks.

Whether you’re a seasoned trader or just starting out, Trade Genius Expert Advisor offers a robust solution to automate your trading strategies and achieve consistent success in the forex market.

How It Works: Harnessing Technical Indicators for Optimal Trades

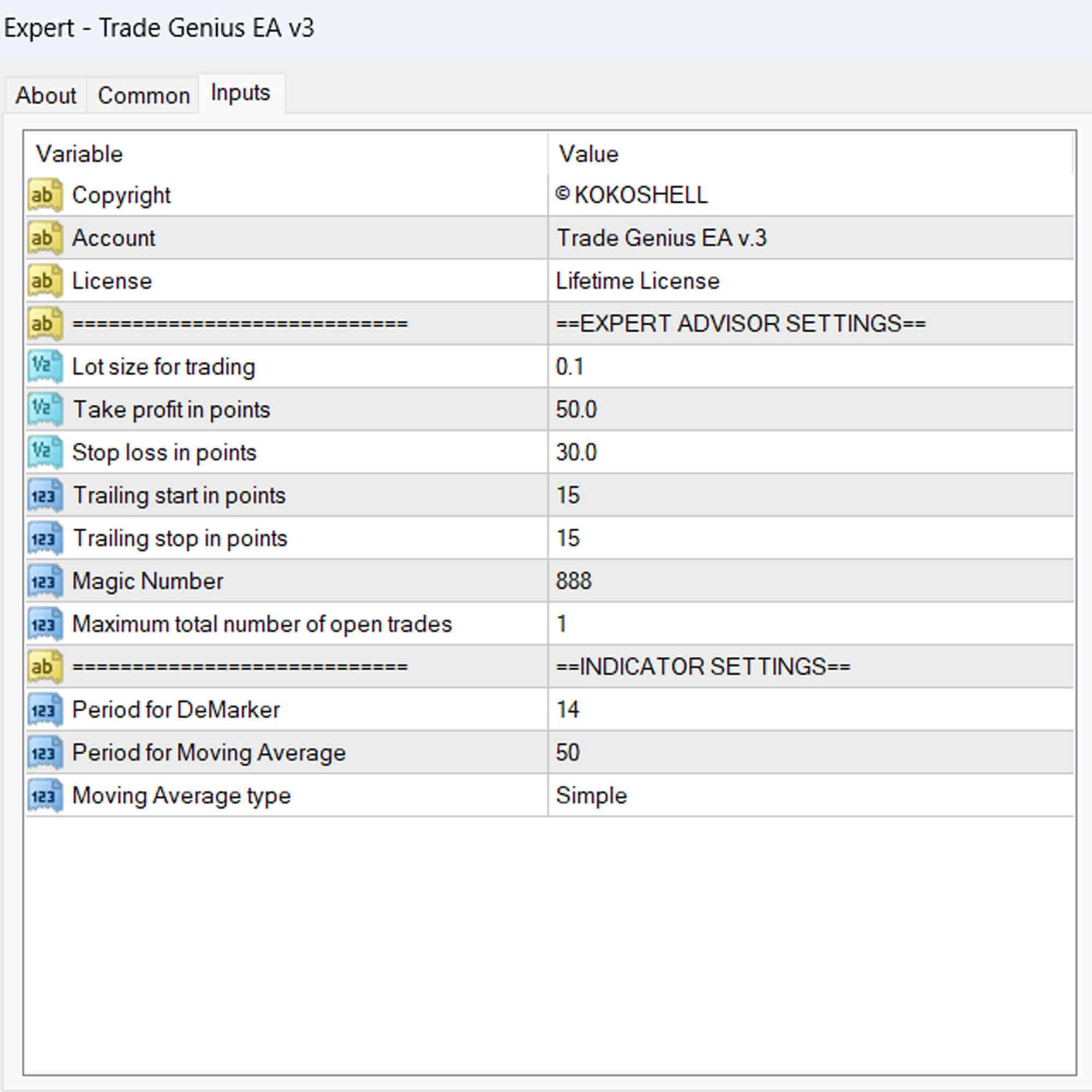

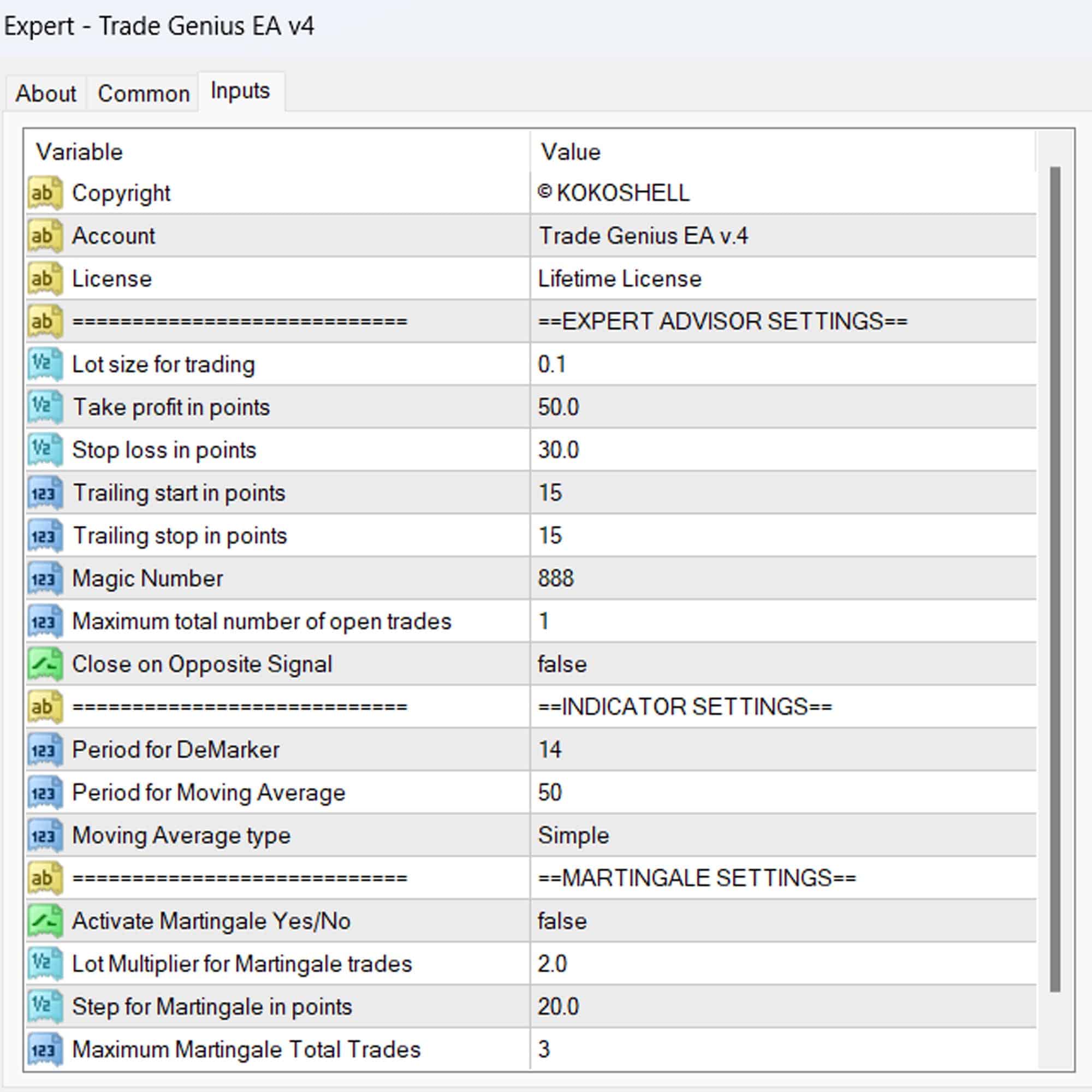

Trade Genius EA utilizes a combination of the DeMarker indicator and Moving Averages to identify potential trading opportunities. Furthermore, the DeMarker indicator helps determine overbought and oversold conditions, while Moving Averages confirm the trend direction. When a buy or sell signal is triggered, the EA automatically executes the trade with predefined take profit and stop loss levels.

Additionally, the EA features a trailing stop mechanism to lock in profits as the market moves in your favor. Consequently, this ensures that you maximize your trading outcomes.

Key Features: The Ultimate Trading Toolbox

- DeMarker Indicator: Detects overbought and oversold market conditions to generate accurate signals.

- Moving Average Confirmation: Confirms trend direction to ensure high-probability trades.

- Customizable Parameters: Moreover, adjust lot size, take profit, stop loss, and more to suit your trading style.

- Martingale Strategy: Additionally, optional Martingale settings enhance profitability on successive trades.

- Trailing Stop: Furthermore, protect your gains with dynamic trailing stop adjustments.

- Candlestick Pattern Detection: Enhance signal accuracy with built-in candlestick pattern recognition.

- Lifetime License: Lastly, enjoy unlimited access with a one-time purchase.

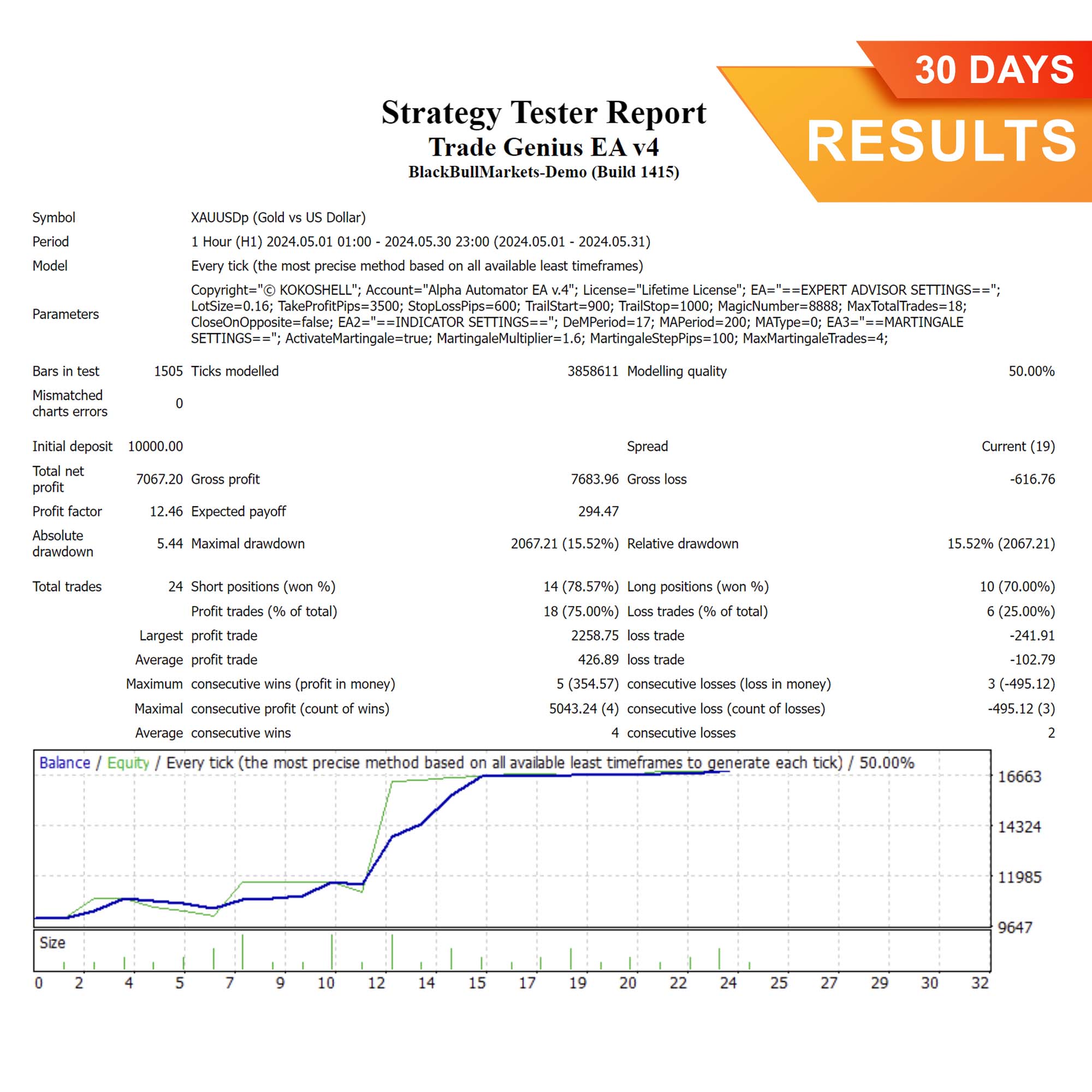

Why Choose Trade Genius EA? Your Path to Consistent Profits

Trade Genius EA for Metatrader 4 is engineered to provide traders with a competitive edge. By automating complex trading strategies and leveraging powerful indicators, it eliminates emotional decision-making and enhances trading efficiency. Moreover, its advanced features, combined with user-friendly customization options, make it an invaluable tool for traders seeking consistent and reliable performance.

Elevate Your Trading with Trade Genius EA

Experience the future of automated trading with KOKOSHELL’s Trade Genius Expert Advisor for Metatrader 4. Designed to adapt to various market conditions and trading styles, this Expert Advisor ensures you stay ahead of the curve. Consequently, start maximizing your trading potential today and achieve unparalleled success in the forex market with Trade Genius EA. Therefore, you will see significant improvements in your trading strategy.

Unlock the full potential of your trading strategy with Trade Genius MT4 Expert Advisor – where precision meets profitability.

Carlos Alvarez –

Trade Genius EA boosted my trading accuracy. Consistent gains!

Emily White –

Really helpful tool, made my trading strategy more effective. Easy to use.

Ava Johnson –

Great for refining strategies, but a bit pricey. Overall, very satisfied with the performance.

Miguel Ramirez –

This EA has significantly improved my trading outcomes. Reliable and efficient.

Sofia Lopez –

Trade Genius transformed my trading. Steady profits and better decision-making.

Olivia Brown –

This trading advisor is incredible! Setting it up was a snap, and the profits have been amazing. The strategy it follows is smart and effective, and the risk management ensures my investments are protected. It has made trading so much more rewarding and less stressful. I’m extremely happy with the results!