Unlock the Potential of Trend Trading with EURUSD Trend Trading EA

Welcome to the advanced world of automated forex trading with the EURUSD Trend Trading EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL. This Expert Advisor capitalizes on the trending movements of the EURUSD currency pair.

Consequently, traders can maximize their profits with minimal effort. Whether you are a novice trader or a seasoned expert, the EURUSD Trend Trading Expert Advisor offers a sophisticated, hands-off solution. Thus, it elevates your trading strategy and achieves consistent results.

How It Works: Leveraging Advanced Indicators for Optimal Performance

EURUSD Trend Trading Expert Advisor utilizes powerful technical indicators to identify high-probability trading opportunities. Specifically, the algorithm analyzes the 50-period and 200-period Exponential Moving Averages (EMA) alongside the Moving Average Convergence Divergence (MACD) to generate precise buy and sell signals:

- Buy Signal: Occurs when the 50 EMA crosses above the 200 EMA and the MACD histogram is positive.

- Sell Signal: Triggered when the 50 EMA crosses below the 200 EMA and the MACD histogram is negative.

This dual-indicator strategy aligns trades with the prevailing trend. Therefore, it enhances the likelihood of profitable outcomes.

Key Features: Cutting-Edge Tools for Maximum Profitability

The EURUSD Trend Trading EA for Metatrader 4 offers a comprehensive set of advanced features to maximize profitability in the EURUSD market.

- Precision Signal Generation:

- 50 EMA and 200 EMA: Identifies trend changes and provides accurate trade signals. Moreover, it ensures timely entries and exits.

- MACD: Confirms trend strength and momentum, enhancing signal reliability.

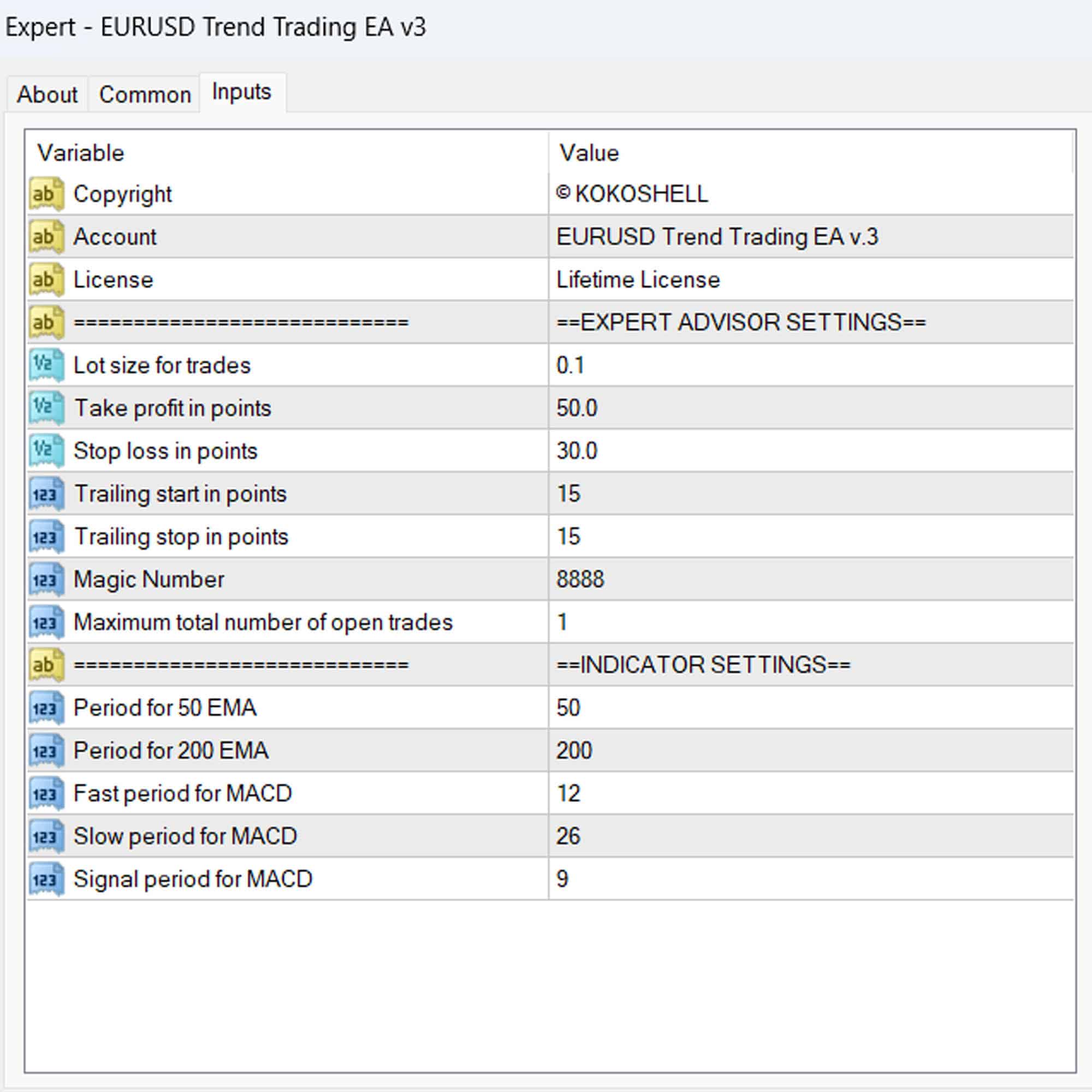

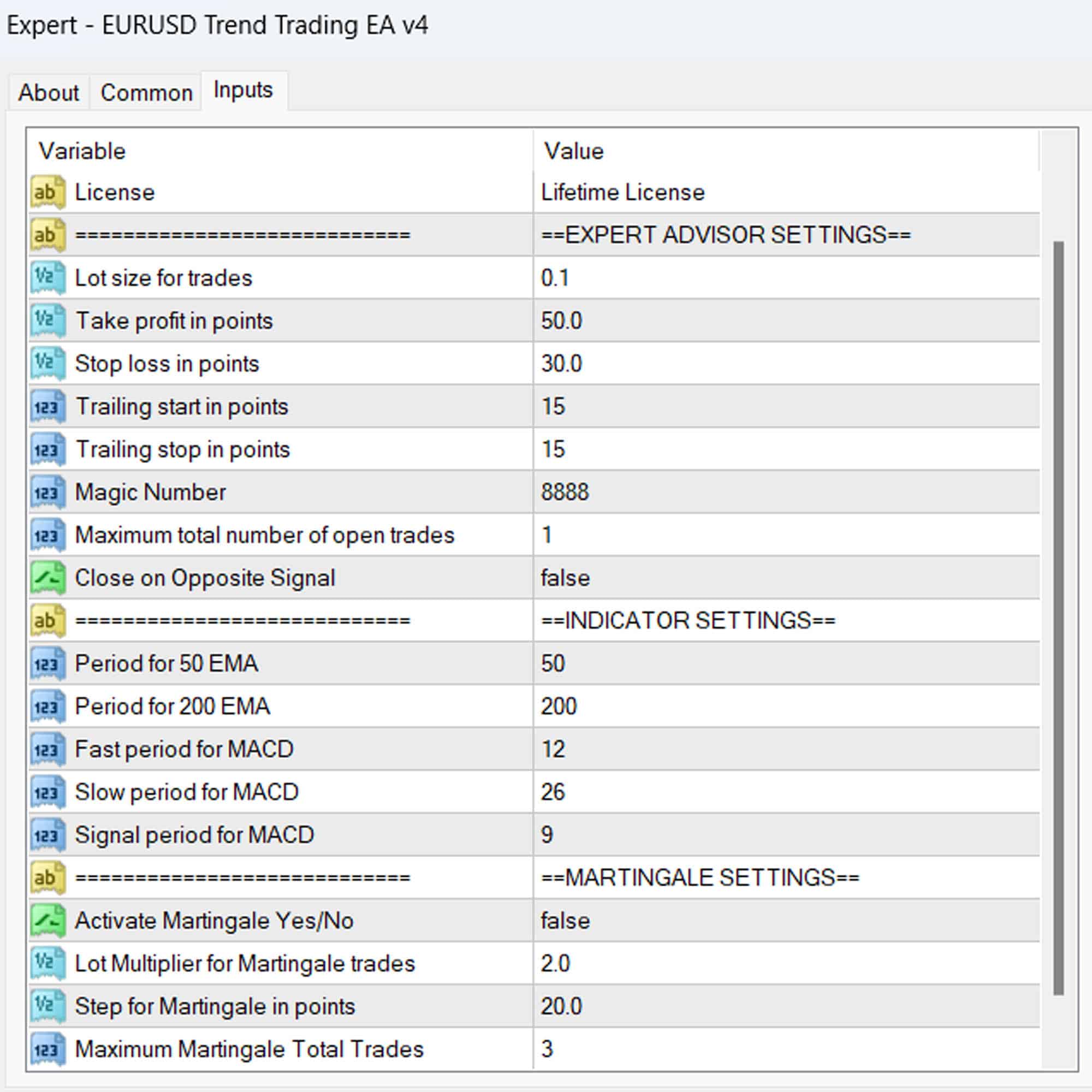

- Customizable Settings:

- Lot Size: Adjustable to suit different trading preferences and account sizes. Additionally, you can modify parameters as market conditions change.

- Take Profit & Stop Loss: Predefined levels to ensure disciplined trading. Consequently, these settings help manage risks effectively.

- Trailing Stops: Secure profits by adjusting stop loss levels as trades become profitable. Therefore, they maximize gains.

- Martingale Strategy:

- Martingale Multiplier: Increases lot sizes after losses to recover previous losses. This strategy enhances potential recovery.

- Step Pips & Max Trades: Customizable settings to control the martingale strategy effectively. Furthermore, they manage risks.

Why Choose EURUSD Trend Trading EA: Consistent Success in Trend Trading

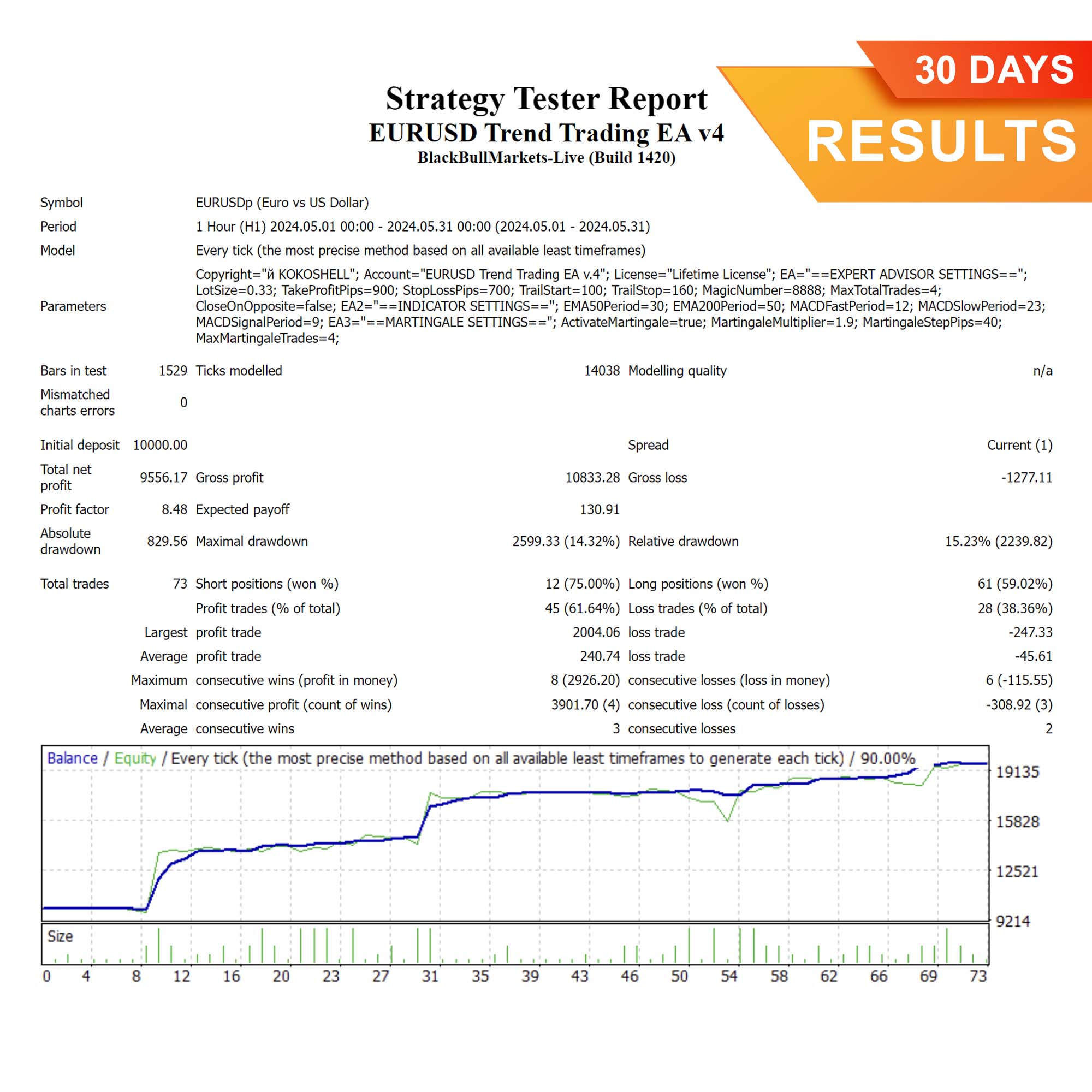

- Proven Performance: EURUSD Trend Trading EA has undergone extensive testing to ensure consistent and reliable performance. Its adaptive algorithms respond effectively to market changes.

- User-Friendly Interface: Designed for both novice and experienced traders, EURUSD Trend Trading EA features an intuitive interface for easy installation, configuration, and performance monitoring.

- Comprehensive Support: Benefit from KOKOSHELL’s dedicated support team. They are ready to assist with installation, setup, and any queries. Consequently, you get the most out of your trading experience.

Elevate Your Trading with EURUSD Trend Trading Expert Advisor

Integrate the EURUSD Trend Trading EA into your trading arsenal and experience the benefits of automated, precise, and profitable trading. With its advanced features and robust risk management, this Expert Advisor is designed to help you achieve consistent success in the forex market. Moreover, don’t miss the opportunity to enhance your trading performance—try the EURUSD Trend Trading Expert Advisor for MT4 (Metatrader 4) by KOKOSHELL today.

Arthur Lee –

Transformed my trading! Profits up significantly.

Manole –

Exceptional tool! Highly effective.

Patrick White –

Solid performance but needs more customization options.

Sofia Ramirez –

My trading success has never been better. Highly recommend.

Kevin –

Needs more input parameters. Requires backtesting.

Ava Sanchez –

Outstanding results! My profits have soared.

Benjamin Davis –

Reliable signals and solid strategy.

Emily Clark –

Fantastic tool! Easy to use and very profitable.

Jennifer Wilson –

Wow! This trading advisor has been a game-changer for me. The setup was easy, and the profits have been impressive. The strategic insights are spot-on, and the risk management features are top-notch. This tool has made trading so much more rewarding. I couldn’t be happier with the results.