Elevate Your Trading Strategy with CCI EA

Unlock the full potential of your trading strategy with the CCI EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL. Specifically engineered to optimize your trading decisions using the powerful Commodity Channel Index (CCI) indicator, this expert advisor (MT4 EA) offers a comprehensive suite of features. Consequently, whether you are a beginner or an experienced trader, CCI Expert Advisor enhances your trading efficiency and performance.

How It Works: Leveraging CCI for Automated Trading

CCI EA operates by analyzing market conditions using the CCI indicator, which measures the strength of price movements. When the CCI crosses above -100, the EA automatically opens buy orders, indicating a potential upward trend. Conversely, it opens sell orders when the CCI crosses below 100, suggesting a potential downtrend.

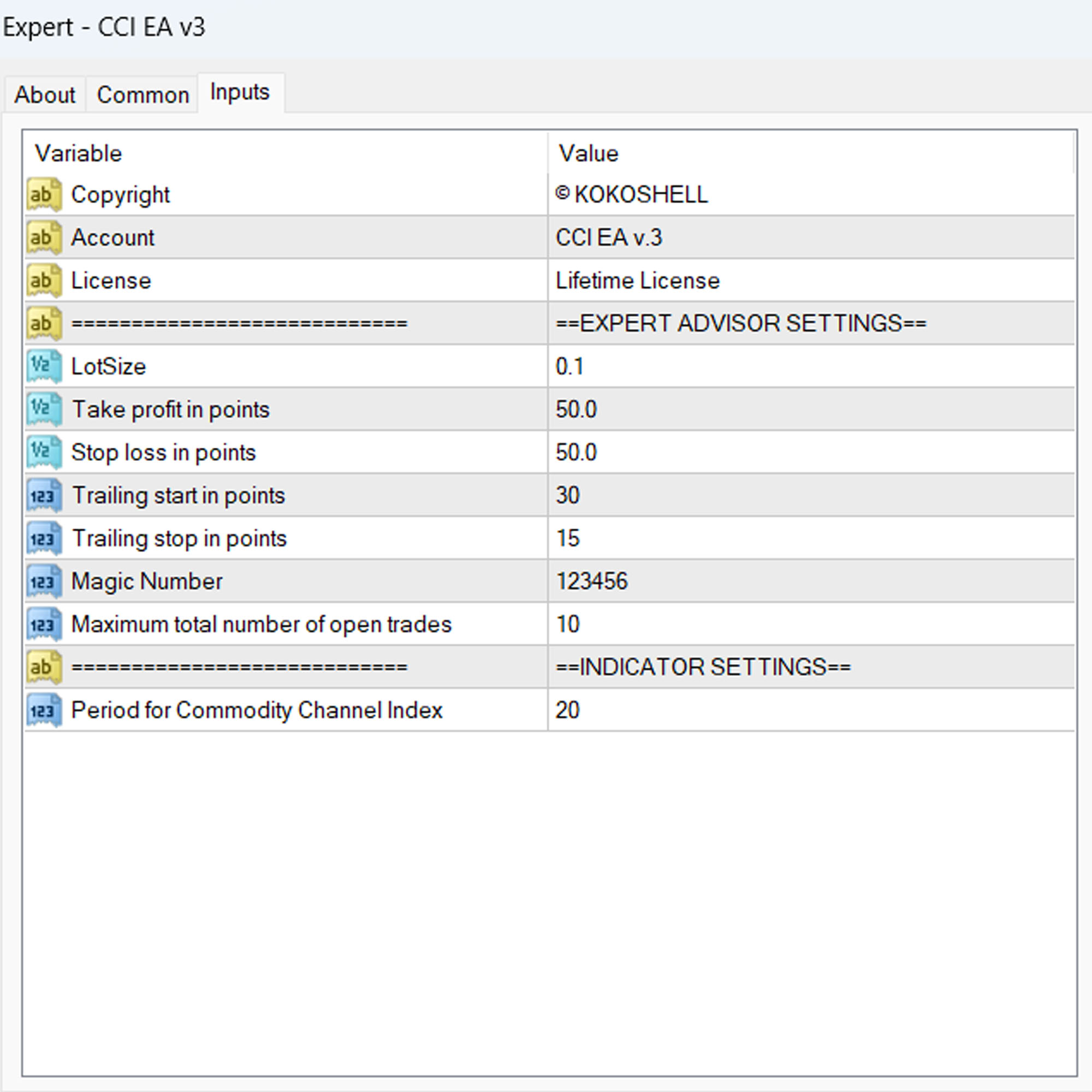

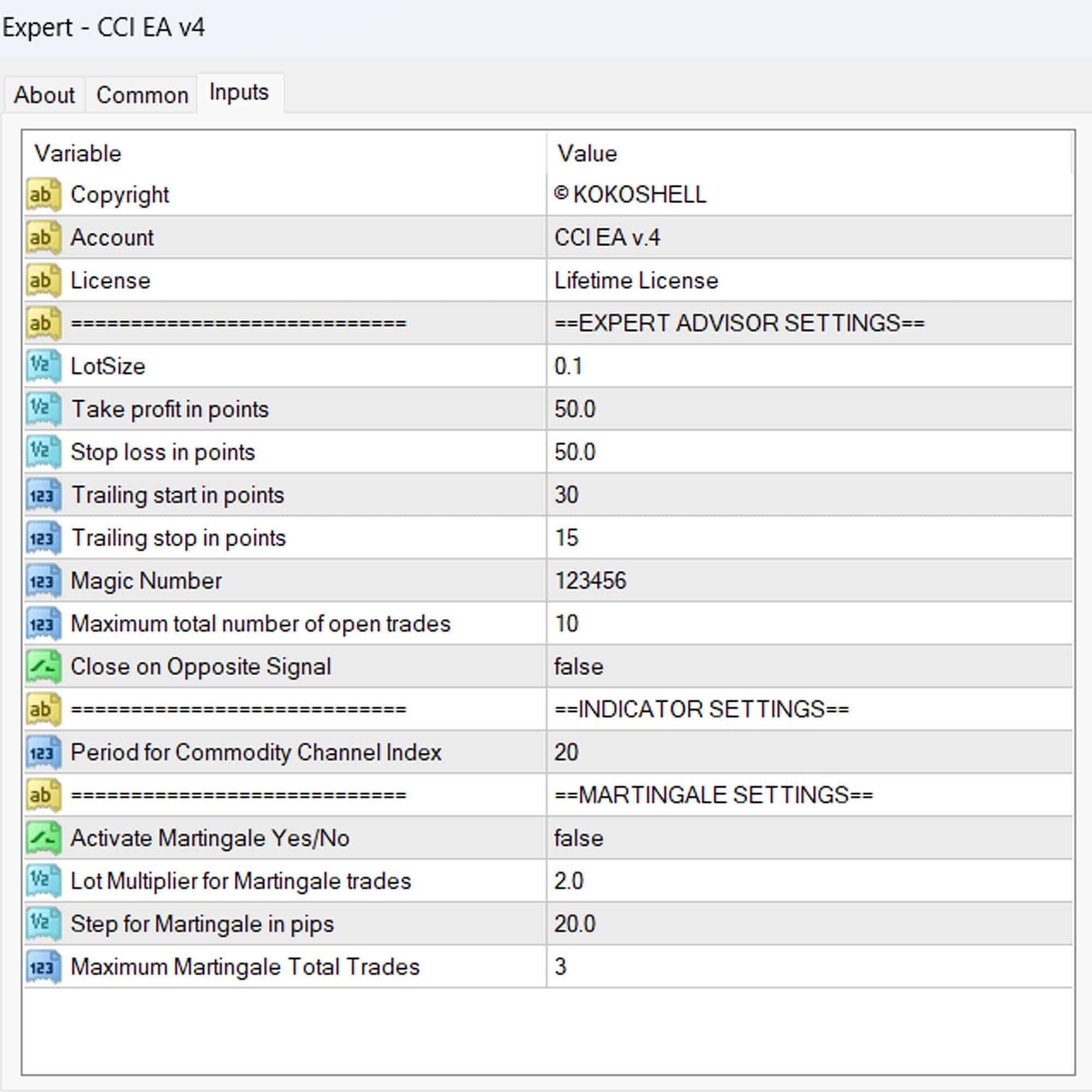

Additionally, the EA’s functionality includes customizable parameters, allowing you to set your preferred lot size, take profit, stop loss, and trailing stop values. Furthermore, you can activate an optional Martingale strategy to increase lot sizes after losses, aiming to recover losses and secure profits efficiently.

Key Features

- CCI Indicator Strategy: Utilizes the CCI indicator to detect and capitalize on strong price movements.

- Customizable Settings: Adjust parameters such as lot size, take profit, stop loss, and trailing stops to suit your trading style and risk tolerance.

- Martingale System: An optional feature that increases lot sizes after losses to enhance recovery and profitability.

- Robust Risk Management: Features include maximum total trades, trailing stops, and a close-on-opposite-signal function to manage risk effectively.

- Fully Automated Trading: Executes trades automatically based on predefined settings, reducing the need for manual intervention and minimizing emotional decision-making.

Why Choose CCI EA?

CCI EA stands out for its reliability, flexibility, and performance. It accommodates a wide range of trading styles, from conservative to aggressive. Moreover, the EA’s user-friendly interface and advanced features enable traders to maximize their trading potential. By leveraging the CCI indicator, CCI Expert Advisor provides accurate market analysis and timely trade execution, leading to consistent results.

Therefore, choosing CCI Expert Advisor gives you a competitive edge in the forex market, ensuring you can capitalize on strong price movements effectively.

Achieve Consistent Success with CCI MT4 Expert Advisor

Transform your trading experience with CCI EA by KOKOSHELL. This expert advisor integrates advanced technical indicators and customizable strategies, empowering you to make informed and profitable trades. Consequently, with CCI Expert Advisor for Metatrader 4, you can optimize your trading strategy, manage risk effectively, and achieve consistent success in the forex market.

Liam –

Great results, very reliable EA.

Sofia Hernandez –

Useful tool, improved my trading strategy.

Lucas Martin –

This EA has significantly boosted my trading performance.

Emma Johnson –

Decent product but can be complex for beginners.

Noah Thompson –

Fantastic tool! My trading efficiency has improved a lot.

David Jones –

I’m thrilled with this trading advisor! The setup was a breeze, and the profits started rolling in almost immediately. Its strategic approach and excellent risk management have made trading so much more rewarding. I couldn’t be happier with the results. Highly recommend this to anyone looking to boost their trading game!