Revolutionize Your Trading with Trade Mastermind EA

Experience unparalleled trading success with Trade Mastermind EA (Expert Advisor) for MT4 (Metatrader 4). This sophisticated Expert Advisor leverages advanced trading algorithms and powerful indicators to ensure precision and profitability in every trade. Moreover, designed for both novice and experienced traders, Trade Mastermind Expert Advisor takes the guesswork out of trading, offering a seamless, automated solution for achieving consistent gains in the forex market.

How It Works: Harnessing Advanced Indicators for Optimal Trades

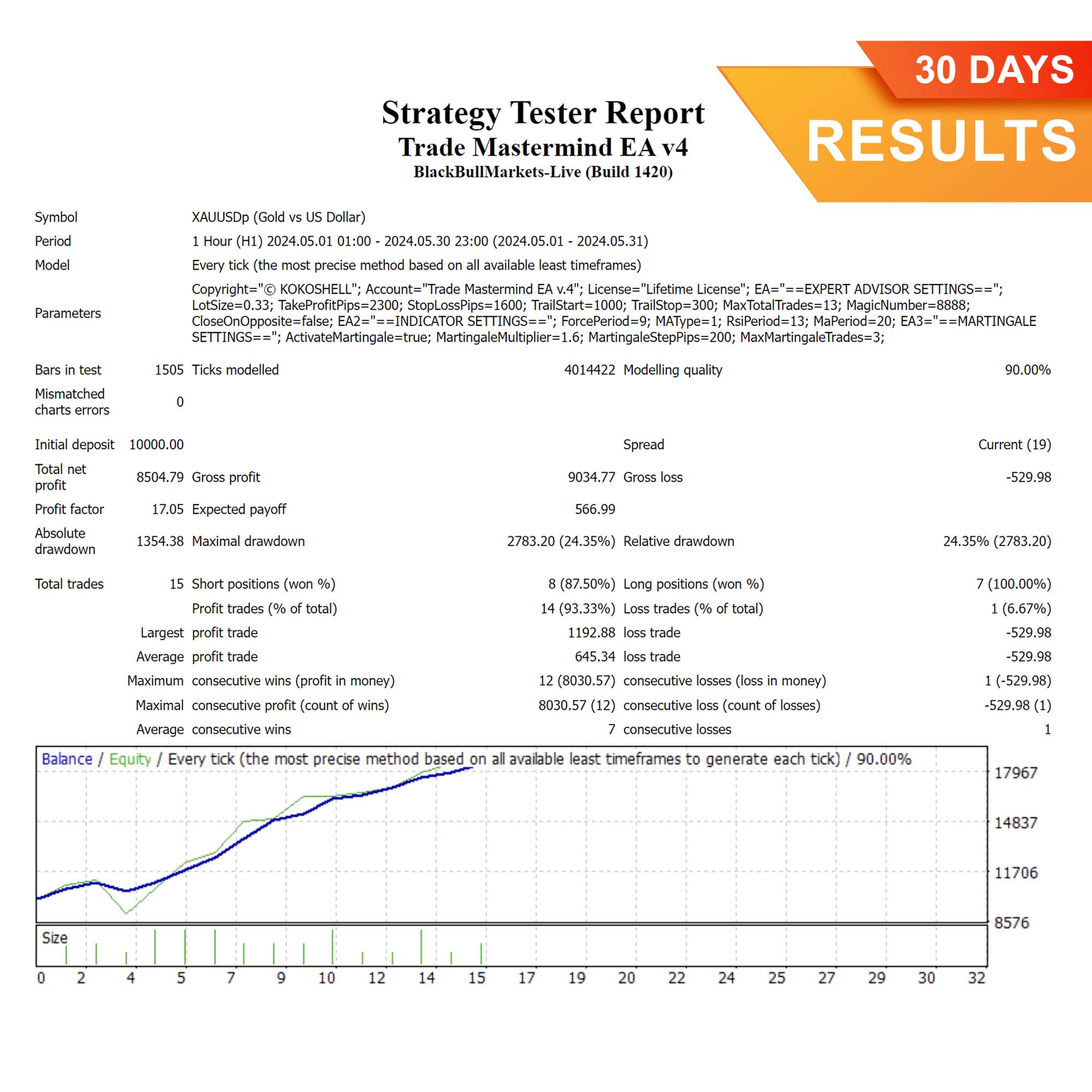

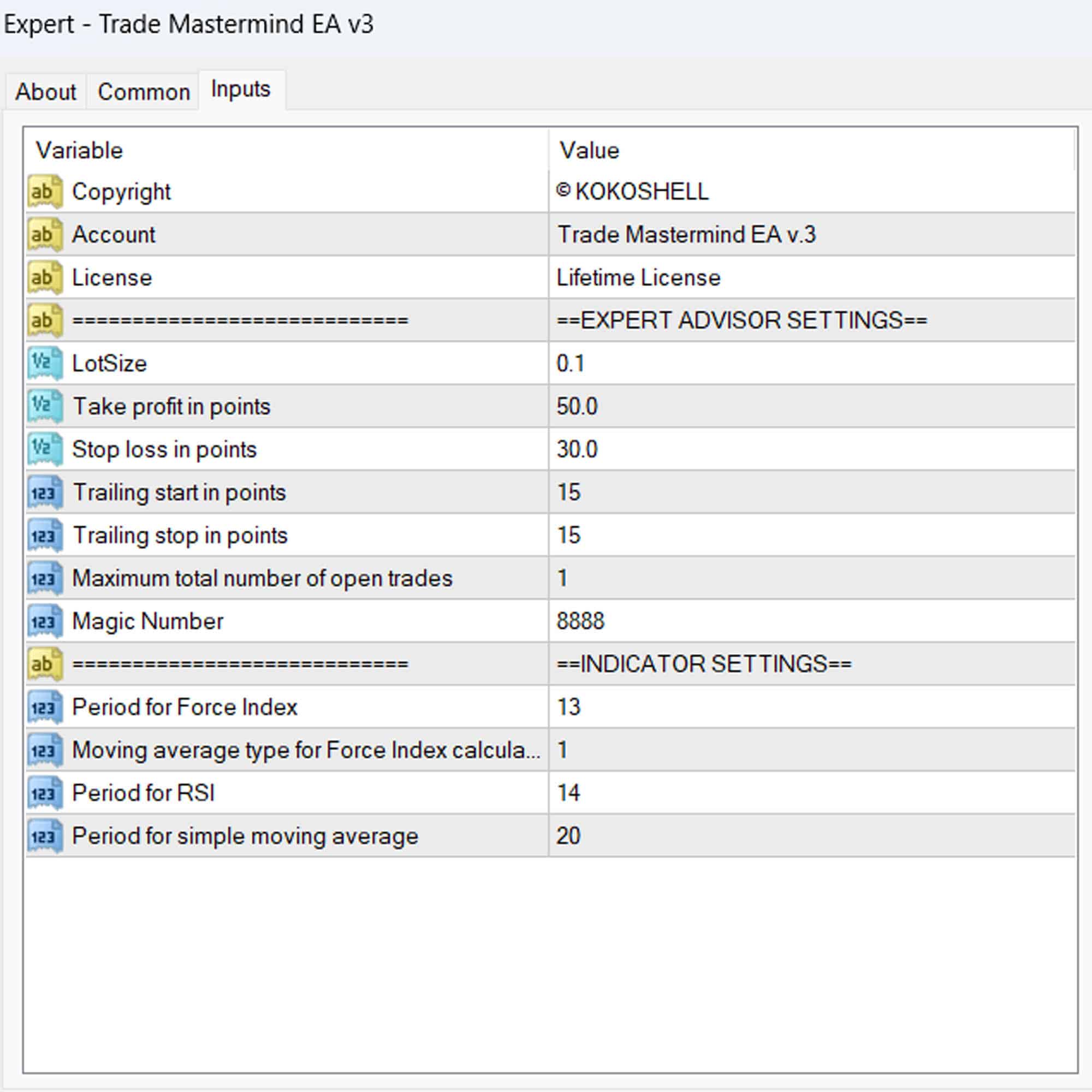

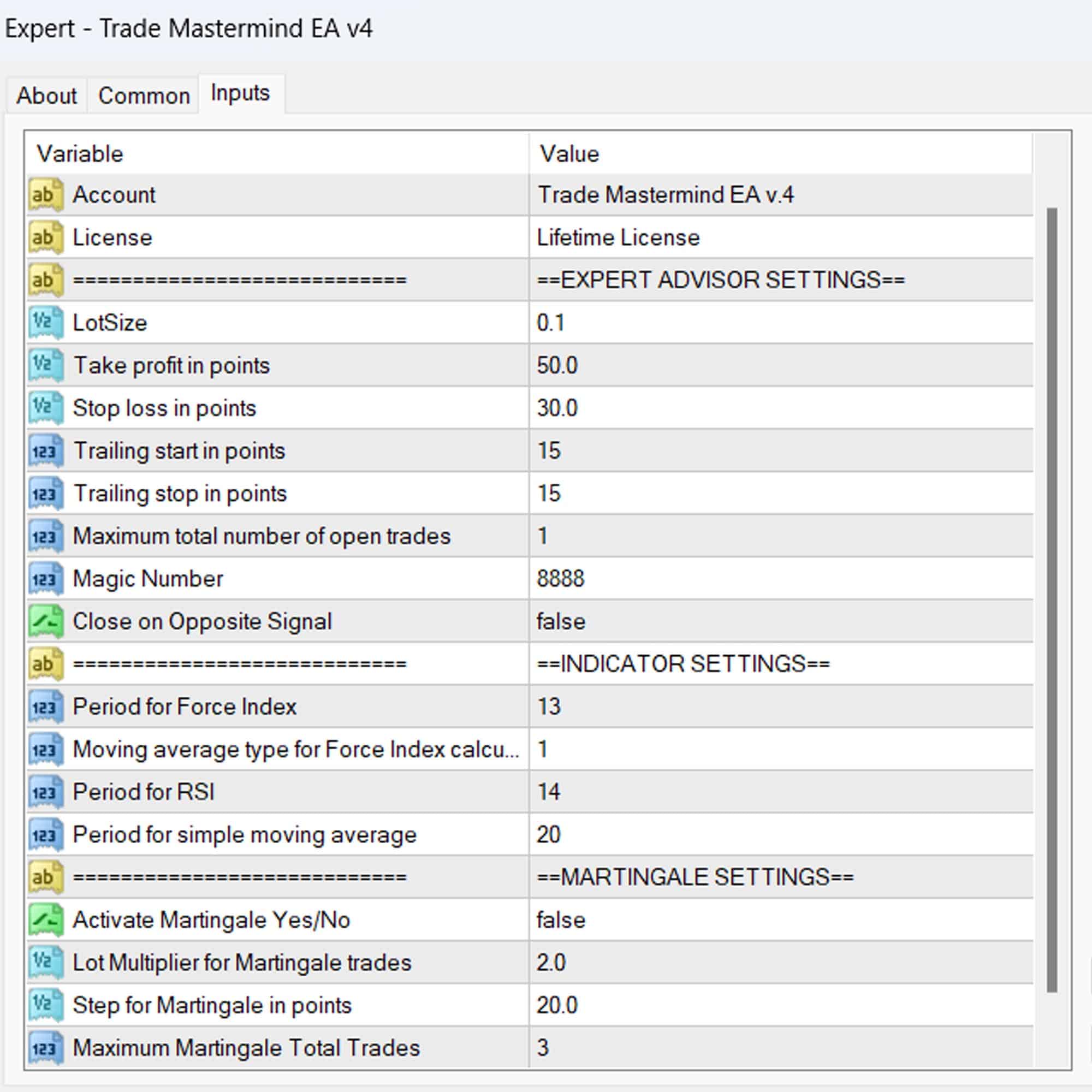

Trade Mastermind EA combines the Force Index, RSI, and Moving Average indicators to generate accurate buy and sell signals. Consequently, by analyzing market trends and price movements, this EA identifies optimal entry and exit points, ensuring each trade aligns with the prevailing market conditions. Furthermore, the integrated Martingale strategy and dynamic trailing stops further enhance trading efficiency, allowing for adaptive risk management and maximized profits.

Key Features: Cutting-Edge Tools for Superior Trading

- Advanced Indicator Analysis: Utilizes Force Index, RSI, and Moving Averages for precise market insights. Additionally, these indicators work together to provide a comprehensive view of market dynamics.

- Customizable Settings: Adjust lot size, take profit, stop loss, and trailing stops to fit your trading style. Moreover, this flexibility ensures that the EA adapts to your specific needs.

- Martingale Strategy: Optional Martingale feature for increasing lot sizes during losing trades to recover losses. Furthermore, this strategy enhances your ability to bounce back from setbacks.

- Automated Trading: Executes trades automatically, thereby removing emotional decision-making from the process. Consequently, this leads to more consistent trading outcomes.

- Trailing Stop Management: Protects profits with dynamic trailing stops, ensuring gains are secured. Additionally, this feature adapts to market movements to lock in profits effectively.

- Fibonacci Levels and Candlestick Patterns: Incorporates advanced technical analysis for enhanced decision-making. Moreover, these tools provide deeper insights into market trends and potential reversals.

Why Choose Trade Mastermind EA? Superior Performance and Ease of Use

Trade Mastermind EA stands out for its precision, reliability, and user-friendly interface. Additionally, designed by experts at KOKOSHELL, this EA offers:

- Consistent Performance: Proven algorithms ensure steady returns in various market conditions. Consequently, you can rely on this EA to deliver consistent results.

- User-Friendly Interface: Easy-to-navigate settings make it accessible for traders of all levels. Moreover, the intuitive design simplifies the setup process.

- Robust Risk Management: Comprehensive features for managing risk and protecting capital. Additionally, these tools help safeguard your investments against market volatility.

- Lifetime License: A one-time purchase with no recurring fees, providing long-term value. Furthermore, you gain lifetime access to updates and support.

Elevate Your Trading Game with Trade Mastermind EA

Trade Mastermind EA for Metatrader 4 is your ultimate tool for achieving trading success. Consequently, with its advanced algorithms, customizable settings, and powerful risk management features, it offers everything you need to navigate the forex market confidently.

Additionally, whether you’re a beginner looking to automate your trades or an experienced trader seeking to enhance your strategy, Trade Mastermind MT4 Expert Advisor is designed to meet your needs and exceed your expectations. Therefore, invest in Trade Mastermind Expert Advisor for Metatrader 4 today and transform your trading journey with KOKOSHELL’s cutting-edge technology.

Emily Martinez –

Trade Mastermind EA has completely transformed my trading strategy. The results are phenomenal!

Carlos Brown –

This EA is a solid tool for improving trades. It’s a bit complex initially but worth the effort.

Olivia Johnson –

Amazing tool! My trading performance has skyrocketed since I started using Trade Mastermind EA.

Liam Thompson –

Trade Mastermind EA is a game-changer. My trades are more accurate and profitable now. Highly recommend!

Isabella Green –

Good EA, but it takes some time to learn. Once you get the hang of it, the results are impressive.

Ethan Roberts –

This EA has improved my trading success rate significantly. Very reliable and effective.

Ava Wilson –

Helpful tool for refining trading strategies. Could use more customization options though.

Jack Harris –

Trade Mastermind EA has boosted my trading results. Easy to use and highly effective.

Mia Davis –

Solid performance overall. It helps me stay consistent with my trades.

Benjamin Scott –

Highly recommend this EA. It has made my trading more consistent and profitable.

Chloe Walker –

Good tool, but it can be a bit pricey. The performance justifies it though.

Daniel Clark –

Excellent tool! My trading accuracy and profits have increased since using Trade Mastermind EA.

Elizabeth Hernandez –

I’m thrilled with this trading advisor! The setup was incredibly easy, and the profits have been impressive. The strategic insights it provides are spot on, and the risk management features are superb. This tool has made trading so much more rewarding. I highly recommend it to anyone serious about trading.