Unlock Market Reversal Insights with Reversal EA

Discover the ultimate tool for pinpointing market reversals with the Reversal EA (Expert Advisor) for MT4 (Metatrader 4). Designed to meticulously analyze price structures and fractal patterns, this expert advisor is your key to identifying potential reversal points in various bar sizes. Consequently, it is ideal for positional traders who combine fundamental or technical valuation models, providing precise timing for entering or exiting trades.

How It Works: Advanced Fractal Analysis for Accurate Reversals

Reversal EA operates using sophisticated fractal analysis to determine possible reversal points in the market. Here’s how it works:

- Fractal Examination:

- Price Structure Analysis: Moreover, it monitors different bar sizes to identify fractal patterns indicating potential reversals.

- Historical Data Utilization: Furthermore, it analyzes up to 500 historical bars to ensure accuracy in detecting patterns.

- Signal Generation:

- Bullish and Bearish Signals: Therefore, it uses specific color-coded signals to denote potential upward (bullish) or downward (bearish) reversals.

- Alert System: Additionally, it provides real-time alerts through sound, email, and push notifications to keep traders informed of potential opportunities.

Key Features: Enhancing Trading Precision and Efficiency

Discover the robust features of the Reversal Expert Advisor for MT4 (Metatrader 4) designed to optimize your trading strategy:

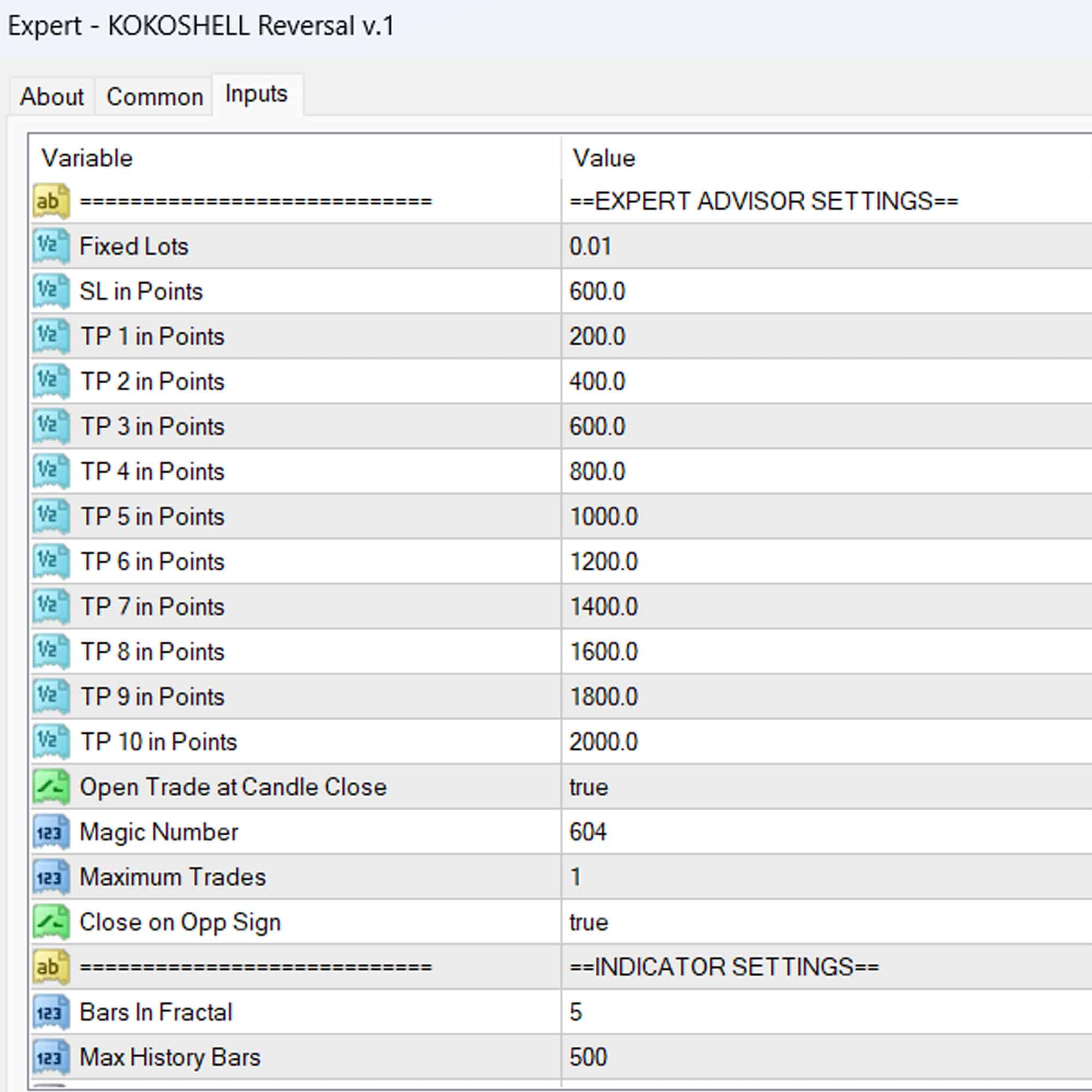

- Fractal Indicator Settings:

- Adjustable Fractal Bar Size: Customize the number of bars in a fractal to suit your trading style.

- Color-Coded Signals: Furthermore, easily identify bullish and bearish patterns with clear visual cues.

- Trade Management:

- Automatic Trade Execution: Additionally, it opens buy or sell trades automatically based on identified reversal signals.

- Customizable Stop Loss and Take Profit: Set predefined SL and TP levels to manage risk and secure profits effectively.

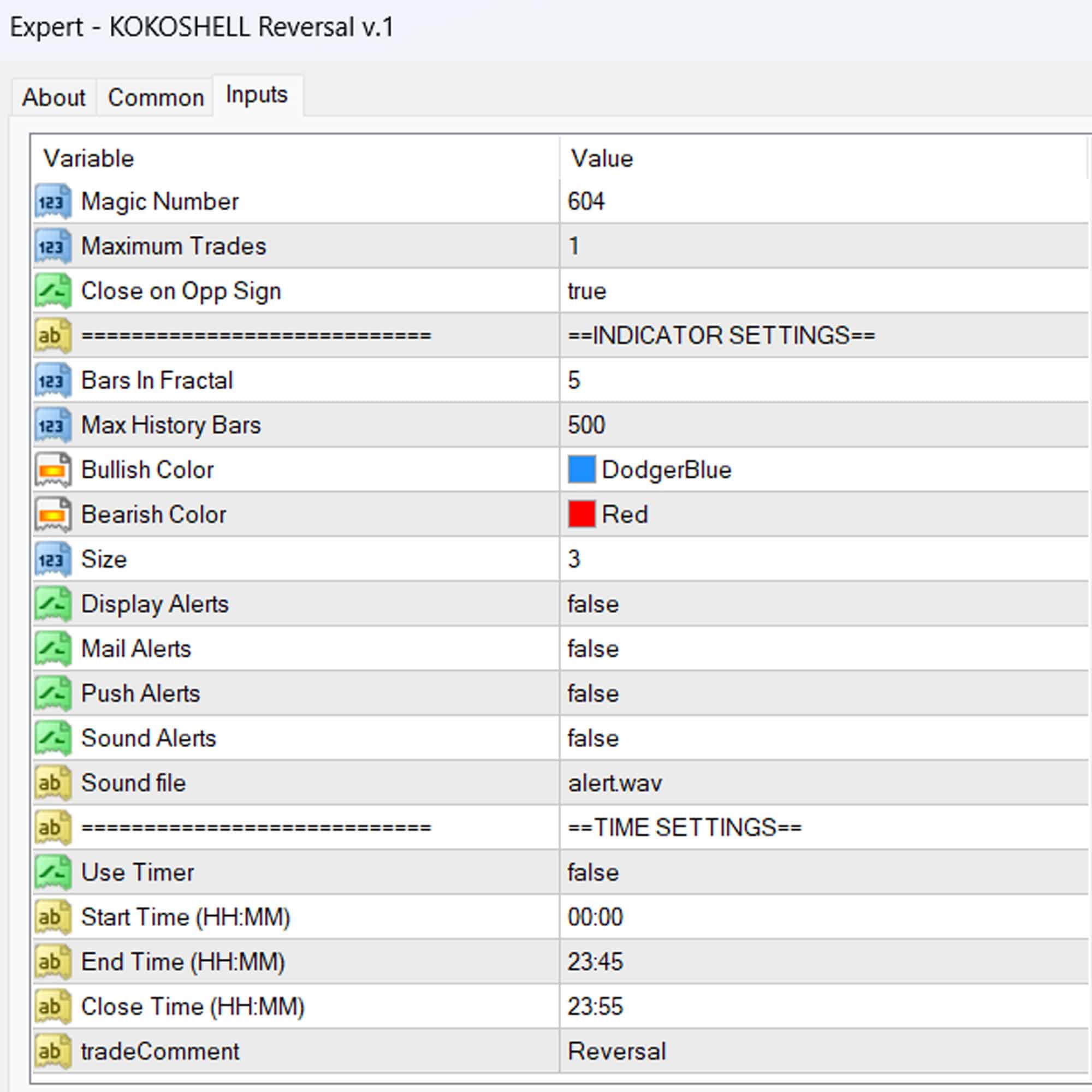

- Alert System:

- Real-Time Notifications: Consequently, receive immediate alerts via sound, email, or push notifications when potential reversals are detected.

- Custom Alert Sounds: Use personalized alert sounds to differentiate between signal types.

Why Choose Reversal EA? The Smart Choice for Positional Traders

Reversal EA stands out as a premier choice for traders aiming to leverage market reversals. Here’s why:

- Accuracy:

- High Precision Signals: Moreover, advanced fractal analysis ensures highly accurate reversal signals, reducing false positives and enhancing trading confidence.

- Flexibility:

- Customizable Settings: Additionally, tailor fractal parameters, alert preferences, and trade execution rules to fit your unique trading strategy.

- Multi-Timeframe Support: Moreover, it works seamlessly across various timeframes, providing versatile application for different trading styles.

- Ease of Use:

- User-Friendly Interface: Furthermore, its intuitive design makes it easy for traders of all experience levels to set up and use the EA effectively.

- Comprehensive Support: Additionally, benefit from detailed documentation and customer support to get the most out of Reversal EA.

Master Market Reversals with Reversal EA

Take control of your trading strategy with the Reversal EA for Metatrader 4 by KOKOSHELL. By leveraging advanced fractal analysis and providing precise reversal signals, this expert advisor empowers you to make informed trading decisions with confidence. Furthermore, it is perfect for positional traders who already have a fundamental or technical valuation model, making Reversal EA the reliable tool you need to identify and capitalize on market reversals effectively.

Ethan Parker –

The tool has improved my trading strategy. Signals are not frequent, but the risk management is solid.

Ava Richardson –

Decent product. The signals don’t come often enough for my liking, but when they do, they are reliable.

Logan Mitchell –

Works well for identifying reversals. The signals are accurate, though not very frequent. Effective risk management.

Sophia Brooks –

Good for cautious trading. Signals are sparse, but the risk management features make it worth using.