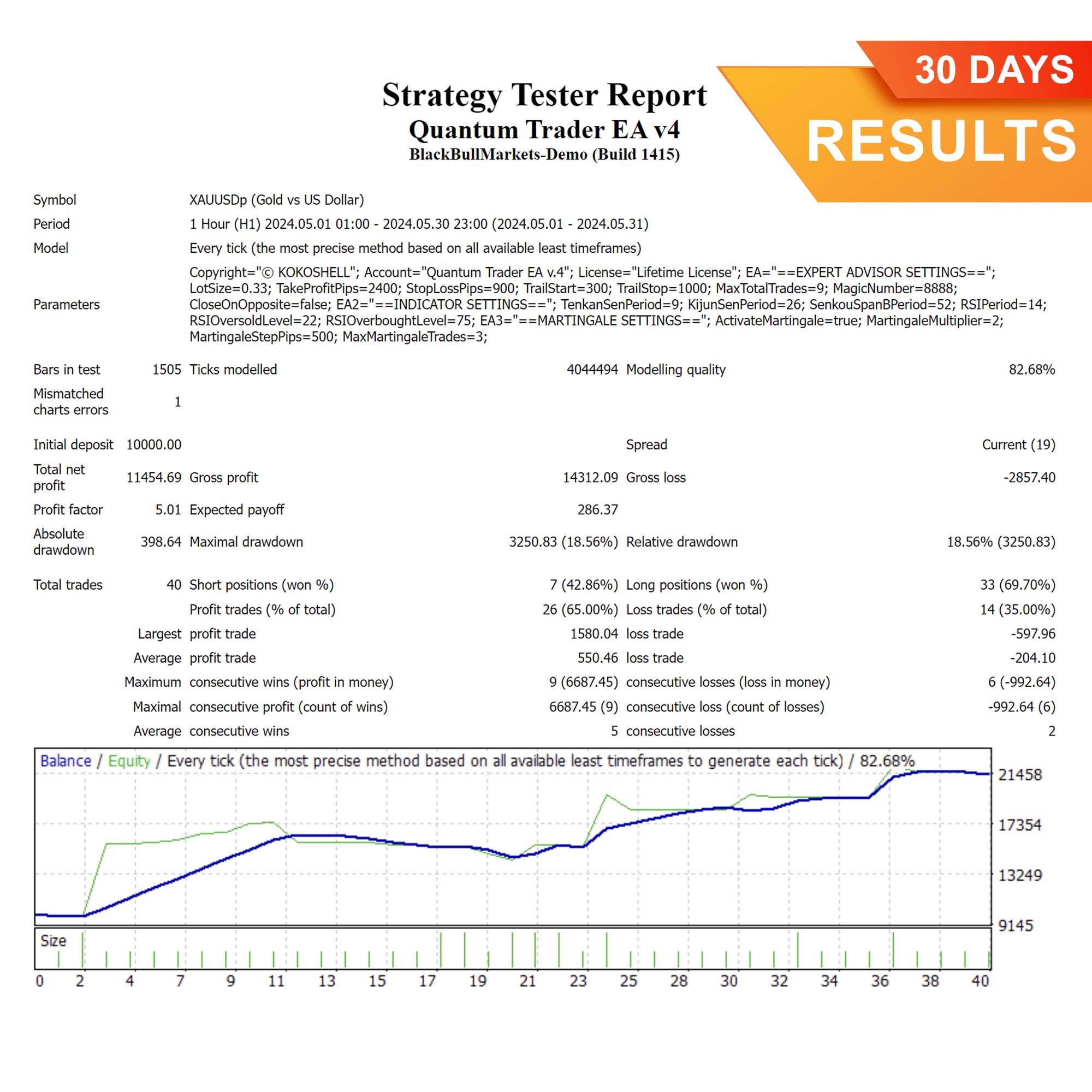

Revolutionize Your Trading with Quantum Trader EA

Welcome to the cutting edge of forex trading with the Quantum Trader EA (Expert Advisor) for Metatrader 4 (MT4). This state-of-the-art Expert Advisor is meticulously designed to harness advanced technical indicators, delivering unparalleled precision and efficiency in your trading operations. Moreover, Quantum Trader Expert Advisor unlocks consistent profits in the dynamic forex market, whether you’re a novice trader or a seasoned expert.

How It Works: Advanced Algorithm for Smart Trading

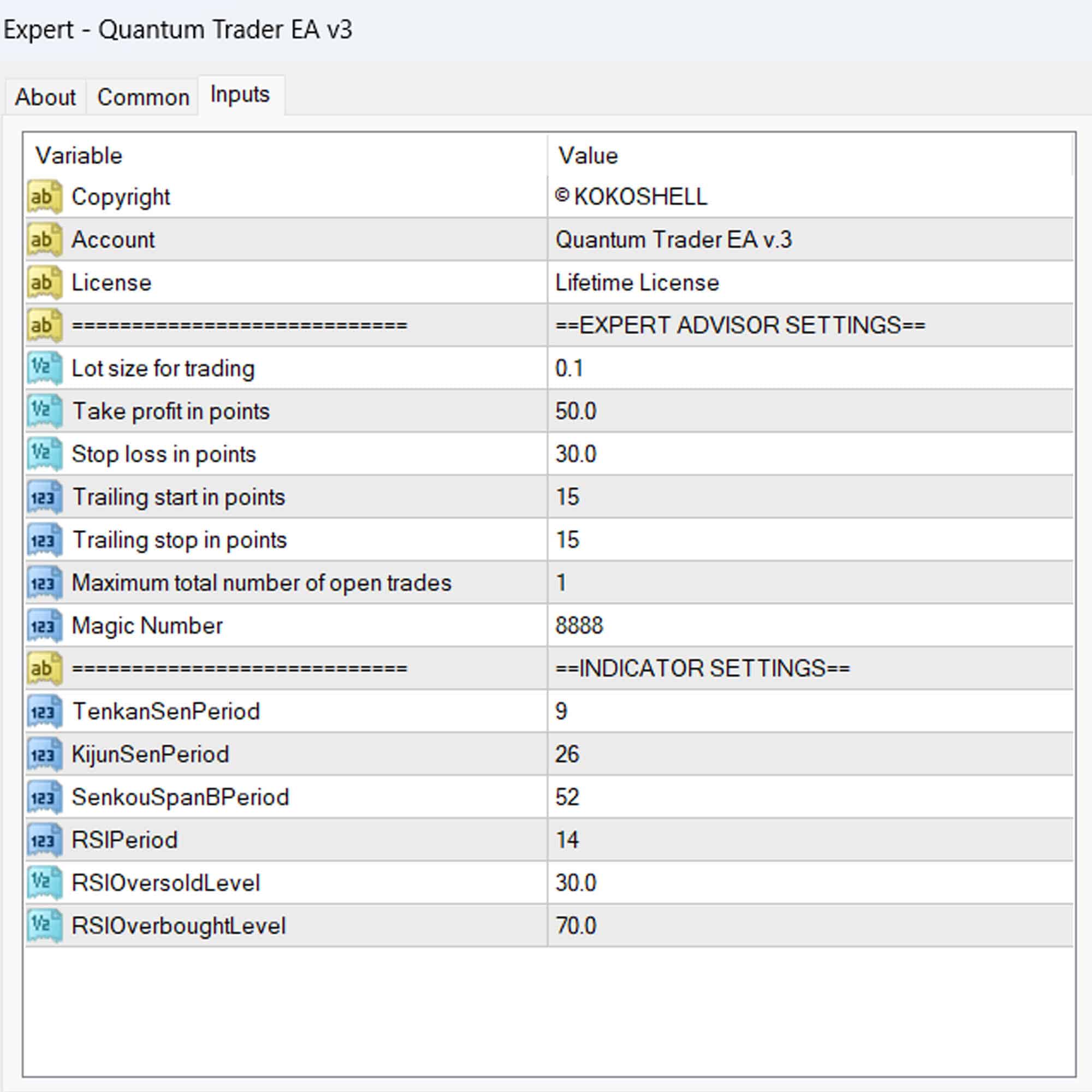

Quantum Trader EA employs a sophisticated combination of the Ichimoku Cloud and RSI (Relative Strength Index) to generate precise trading signals. Specifically, here’s how it operates:

- Buy Signal: The EA triggers a buy order when the price closes above the Ichimoku Cloud and the Chikou Span confirms the trend, with the RSI indicating an overbought condition.

- Sell Signal: Conversely, a sell order is initiated when the price closes below the Ichimoku Cloud and the Chikou Span confirms the trend, with the RSI indicating an oversold condition.

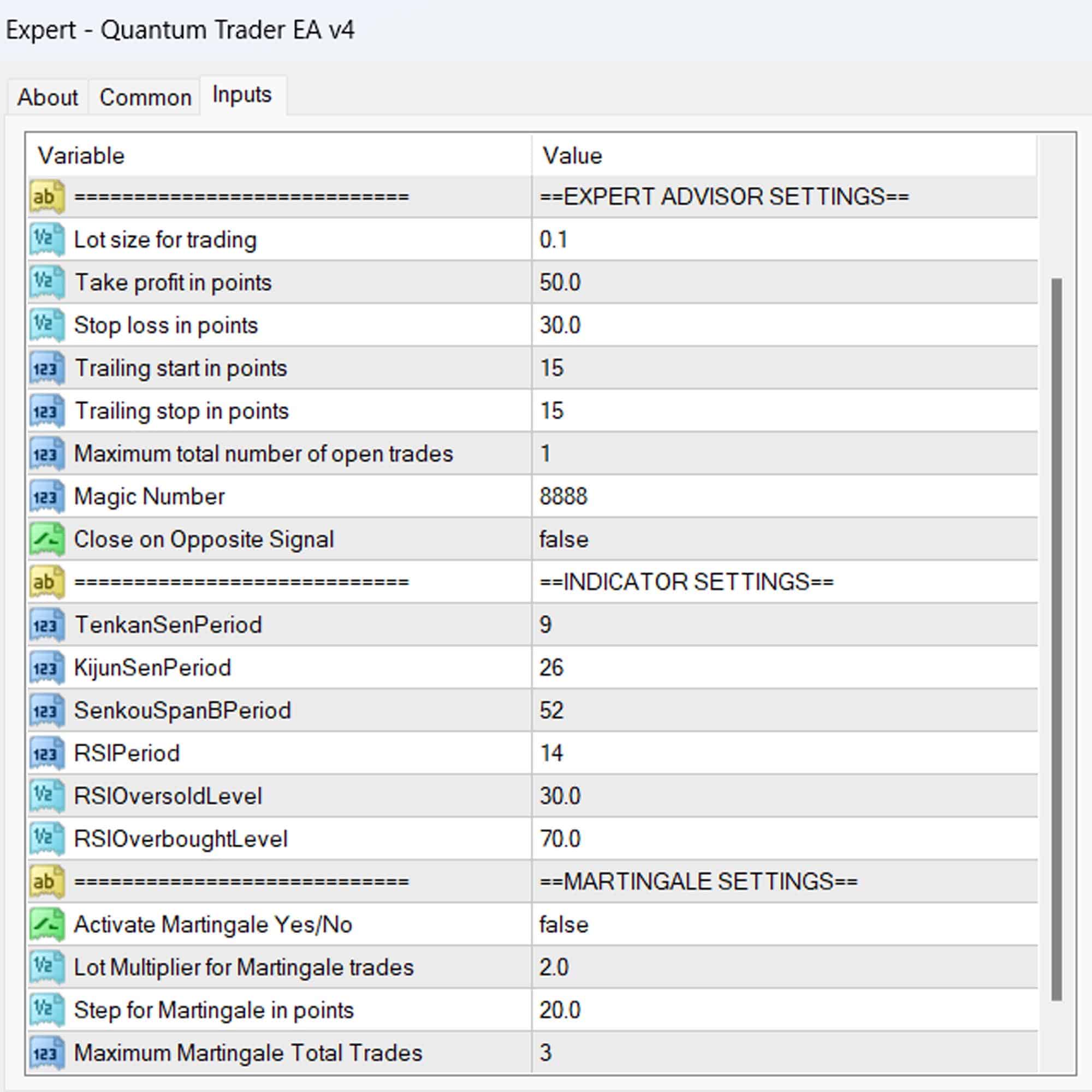

Additionally, the EA incorporates a Martingale strategy to maximize profitability. Furthermore, it includes a trailing stop mechanism to secure gains as the market moves in your favor.

Key Features: Empower Your Trading Strategy

- Precision Signal Generation: Utilizes Ichimoku Cloud and RSI for reliable and timely buy and sell signals.

- Customizable Parameters: Adjust lot size, take profit, stop loss, and trailing stops to suit your trading strategy.

- Martingale Strategy: Additionally, an optional Martingale feature enhances potential profits by increasing trade sizes after losses.

- Automated Execution: Consequently, ensures timely and efficient trade execution based on predefined criteria, reducing the need for manual intervention.

- Robust Risk Management: Employs advanced risk management tools to safeguard your capital and minimize losses.

- Lifetime License: Benefit from continuous updates and dedicated support with a one-time purchase.

Why Choose Quantum Trader EA: Your Competitive Edge in Forex Trading

Quantum Trader EA for Metatrader 4 stands out with its intelligent integration of the Ichimoku Cloud and RSI indicators. Therefore, it provides a robust and reliable trading solution. Moreover, the extensive customization options allow you to tailor the EA to your specific trading style. Additionally, the automated execution ensures precision and efficiency.

The optional Martingale strategy offers an additional layer of profitability. By choosing Quantum Trader MT4 Expert Advisor, you gain a powerful tool that enhances your trading performance and helps you achieve consistent, profitable results.

Transform Your Trading Journey with Quantum Trader Expert Advisor

Elevate your trading experience with the KOKOSHELL Quantum Trader EA. This Expert Advisor delivers a comprehensive, automated trading solution, leveraging the advanced capabilities of the Ichimoku Cloud and RSI indicators. Furthermore, with extensive customization, robust risk management, and an optional Martingale strategy, Quantum Trader Expert Advisor for Metatrader 4 is designed to optimize your trading outcomes.

Michael Adams –

Quantum Trader EA boosted my profits. Highly efficient!

Sophia Martinez –

Impressed with the performance. Took some time to master, but worth it.

Lucas Green –

Fantastic EA! My trading results have been consistently positive since using it.

Isabella White –

Game-changing tool! It has transformed my trading strategy. Highly recommend!

Noah Johnson –

Reliable and effective. My trading accuracy improved significantly.

Emily Roberts –

Quantum Trader EA has made my trading much more profitable. The setup was straightforward.

Liam Anderson –

Good EA for refining trades. Needs better documentation for beginners.

Lisa Rodriguez –

I am beyond impressed with this trading advisor. The setup was straightforward, and the profits started coming in right away. Its strategic approach is brilliant, and the risk management gives me confidence in every trade. This tool has made trading so much more profitable and enjoyable. Highly recommend it!