Elevate Your Trading with ADX EA

Experience the next level of automated trading with the ADX EA (Expert Advisor) for MT4 (Metatrader 4) by KOKOSHELL. This expert advisor enhances your trading strategy by using the powerful ADX (Average Directional Index) indicator. Whether you are a beginner or an experienced trader, the ADX Expert Advisor provides essential tools for consistent and profitable trading results.

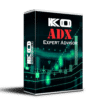

How It Works: Automated Trading with the ADX Indicator

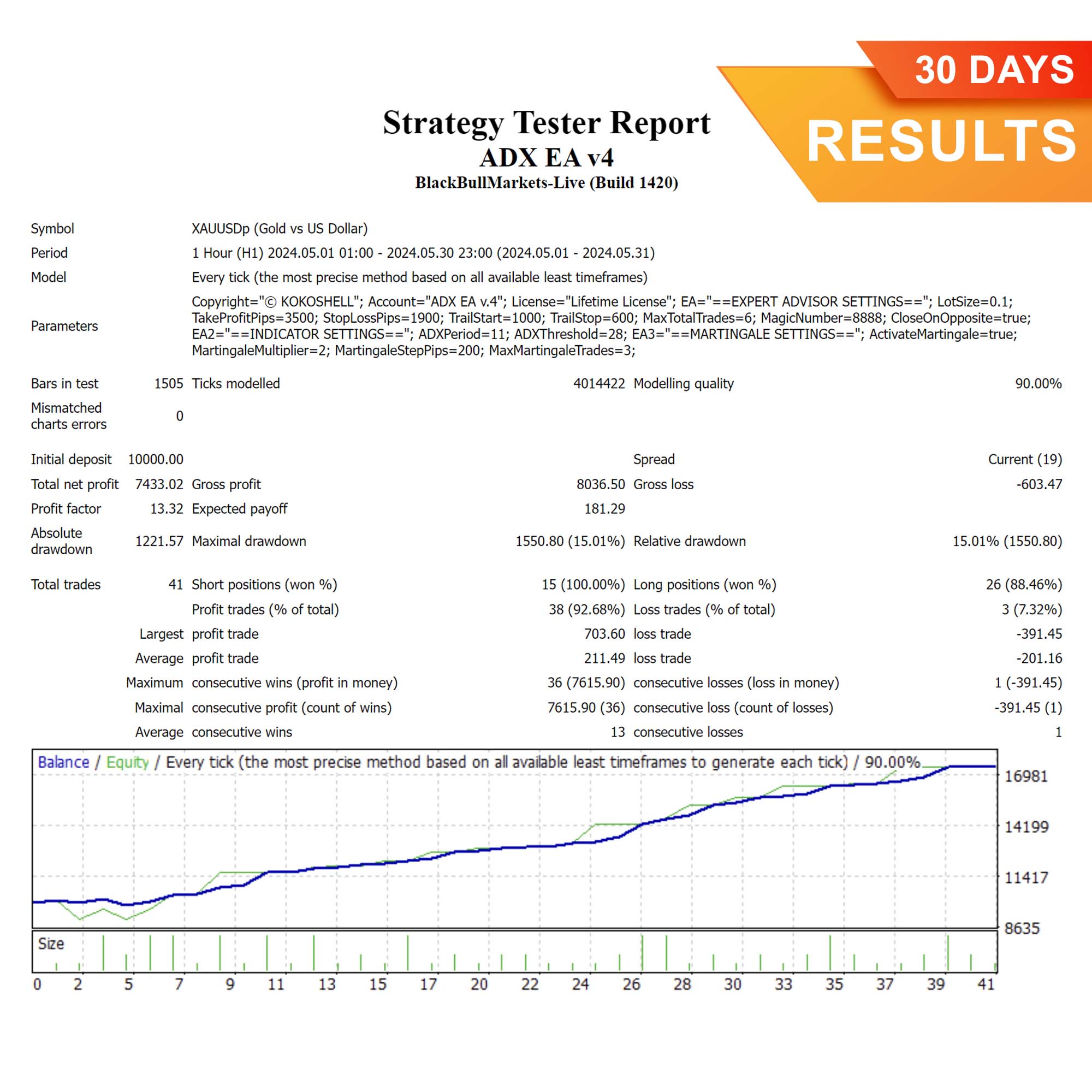

The ADX Expert Advisor for Metatrader 4 analyzes market conditions using the ADX indicator. This indicator measures the strength of a trend. When the ADX value exceeds a predefined threshold, the EA automatically opens buy or sell orders based on the trend direction.

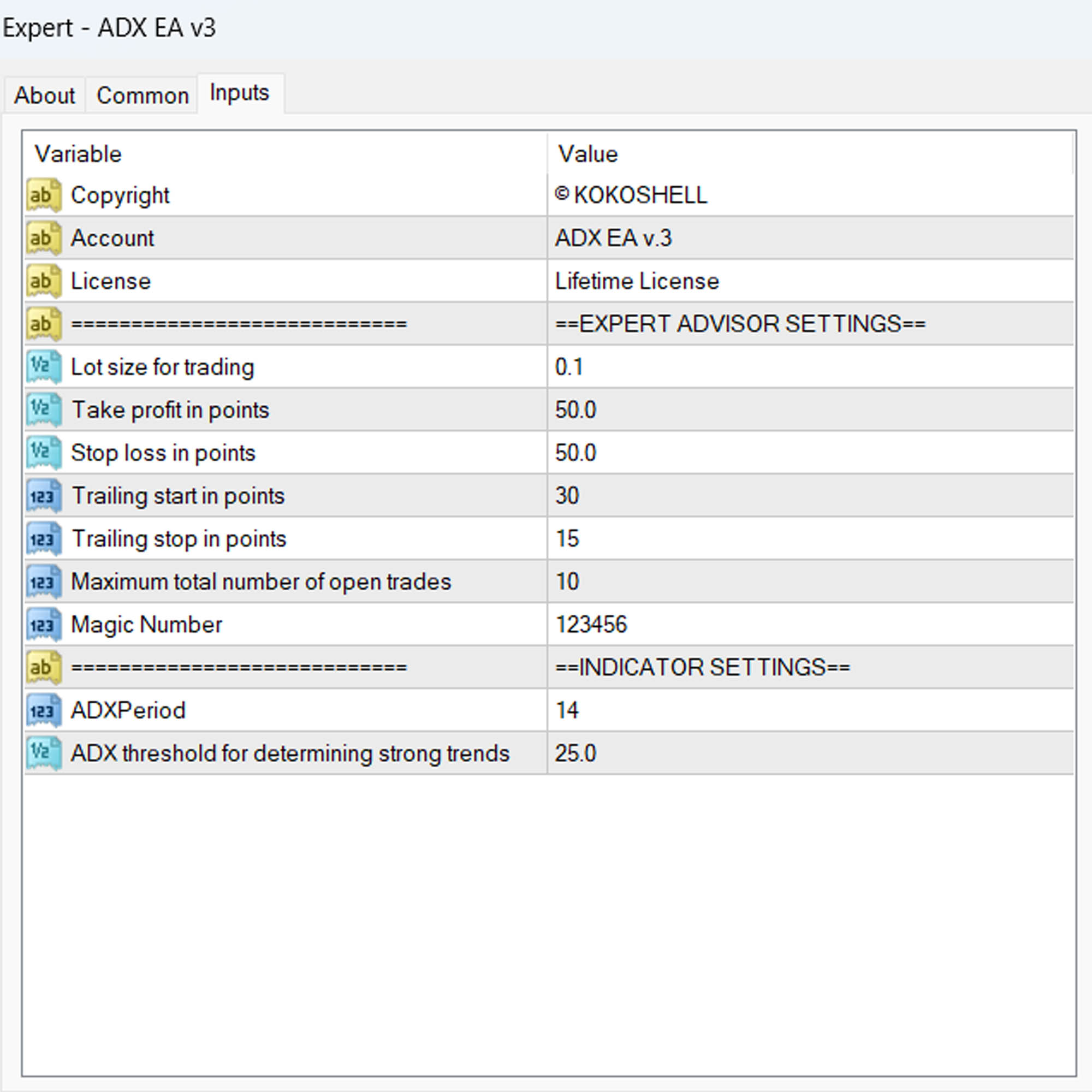

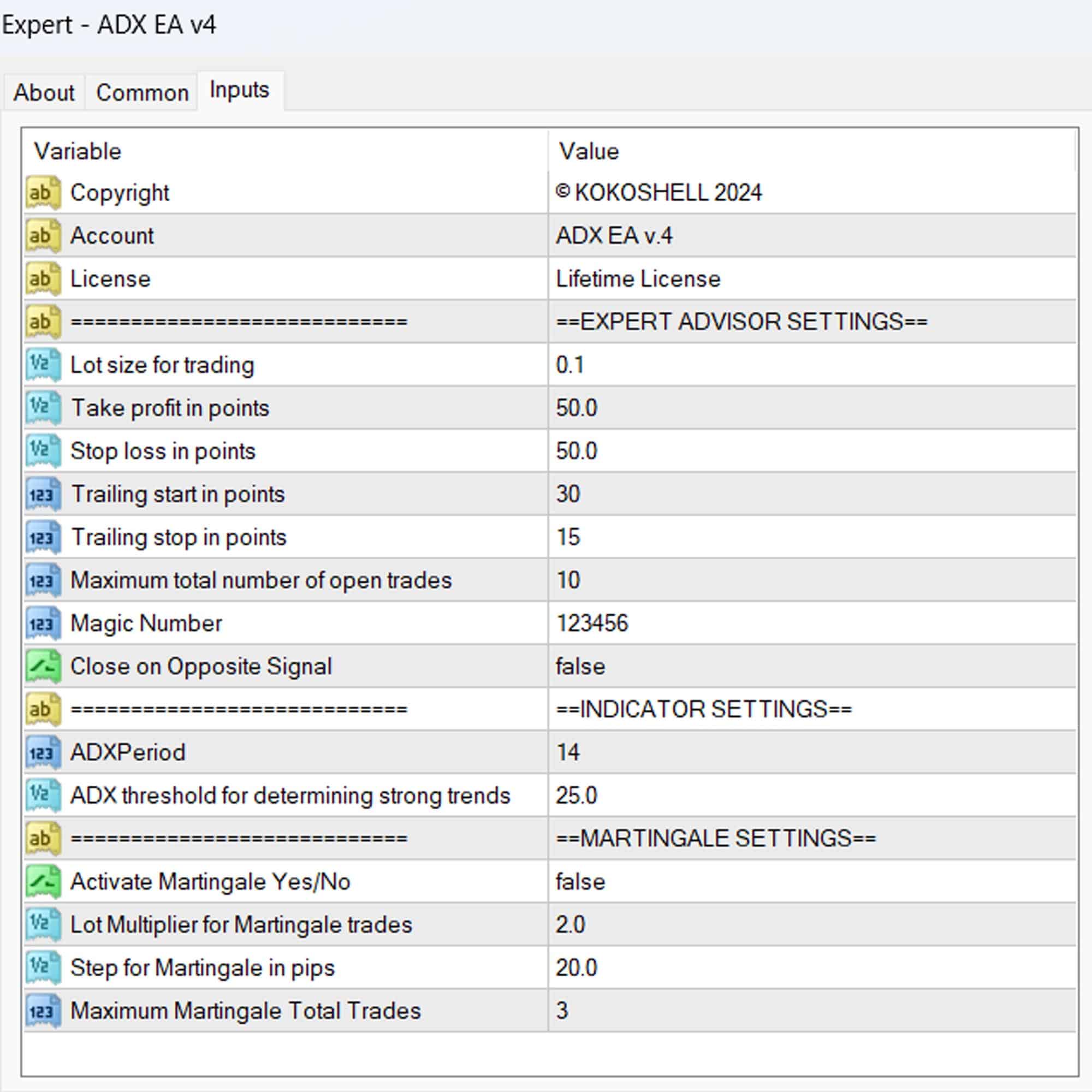

Furthermore, you can customize parameters such as lot size, take profit, stop loss, and trailing stops to match your trading strategy. Additionally, an optional Martingale strategy can be activated to increase lot sizes after losses. This aims to recover losses and secure profits.

Key Features of ADX MT4 Expert Advisor

- ADX-Based Strategy: Utilizes the ADX indicator to detect strong market trends and execute trades accordingly.

- Customizable Settings: Tailor the EA to your trading style with adjustable lot sizes, take profit, stop loss, and trailing stops.

- Martingale System: An optional feature that increases lot sizes after losses to recover and achieve profits.

- Effective Risk Management: Set maximum total trades, trailing stops, and close-on-opposite-signal features to manage risk effectively.

- Fully Automated Trading: Executes trades based on your predefined settings, thus reducing the need for manual intervention and emotional decision-making.

Why Choose ADX EA for Metatrader 4?

ADX EA is a reliable and flexible trading tool. Moreover, it caters to various trading styles, from conservative to aggressive. Additionally, its user-friendly interface and advanced features enable traders to maximize their trading potential.

By leveraging the ADX indicator, this EA helps you make informed trading decisions. As a result, you achieve consistent results. Therefore, choosing ADX Expert Advisor gives you an edge in the competitive forex market. Consequently, it ensures you can capitalize on strong market trends.

Achieve Consistent Success

Consequently, transform your trading experience with the ADX EA. By integrating advanced technical indicators and customizable strategies, this expert advisor further empowers you to make profitable trades.

Moreover, optimize your trading strategy, manage risk effectively, and ultimately achieve consistent success with ADX EA.

John Doe –

This tool has genuinely improved my trading strategy. It’s easy to use, and I’m seeing better results every day.

Emily –

I was skeptical at first, but this EA really delivers. The customization options are a big plus.

Michael –

Since I started using it, my trading has become more consistent and profitable. Highly recommend!

Sarah Lee –

It took a bit to get the settings just right, but now it’s running smoothly and boosting my results.

David Brown –

Fantastic product! It’s helped me trade more confidently and effectively.

Lisa White –

The performance is impressive. It’s reliable and has made my trading easier.

James Taylor –

Been using it for months, and the results are amazing. Definitely worth trying for serious traders.

Karen –

It’s user-friendly and has simplified my trading process significantly.

Chris Wilson –

Solid strategy and flawless automation. Excellent tool for any trader.

Nancy Green –

Noticed a real improvement in my trading outcomes. It’s a powerful and effective tool.

Robert –

While it performs well overall, the lack of input parameters is a drawback. More customization options would be beneficial.

James Smith –

This trading tool is absolutely phenomenal! I’ve seen a dramatic increase in my profits since I started using it. The setup was super easy, and its strategic market insights are spot on. The risk management features are top-notch, ensuring I trade confidently. This advisor has truly transformed my trading experience. Highly recommend!